What if you were handed up to $150,000 in 0% Interest business funding for 6-24 months without Any Documents, nor any collateral and in 100% startup friendly business credit cards?

You’d achieve a Super Power to save your businesses behind time and time again as well as be able to use the funds for growth and Epxansion to kick up your Margins and ROI, right?

Welcome into this Credit Stacking Review where I “Michael” a business owner like yourself and long time business funding expert and credit card stacking pro will be pulling back the curtains to detail what Credit Card stacking is but more importantl what the credit stacking from Jack Mccoll is about and finding out if it is worth it for you or not, but first…

If you came here today to get your question answered to “Is Credit Card Stacking Legit”, Yes, 110% it is. However, if you don’t credit stack your business credit cards (and even personal cards) correctly, you can lose out on A LOT of upfront funds, you can cause too many inquiries pulled from the wrong companies, and you risk running into many mistakes time and time again that I’ve seen others recover after 2+ years….You don’t want that!

So let’s get into this post and figure it out together correctly.

What Is Credit Card Stacking?

In general, credit card stacking is the process of Strategically and tactically adding Multiple 0% interest business credit cards to your business or real estate portfolio in a specific order which allows you as the borrower to get access to multiple 0% interest revolving credit cards at an Introductory rate between 6-24 months that you can tap into quickly to grow and expand your business, for expenses, to pay others, for Real Estate purchases, down payments, and much more.

Imagine a startup or a non-startup business (real estate included) getting acces to multiple 0% interest cards without documents meaning no bank statements, tax returns, P&L, Balance sheets, debts schedules and any of that and being able to repeat the proces in another 30 days when possible…

Oh, and Increasing your current limits with credit increases and building your business credit profile to get access to even more funding through credit and or Business loans like SBA Loans and online bank term loans…You have the PERFECT Recipe to create your favorite meals that you didn’t have to pay for…BOOM!

Going Into Credit Stacking

Before we get into the step-by-step process to Magic of credit card stacking let’s check out what Jack offers which to start with is the credit stacking course…

7-Week Course (Get It ALL)...

In this coure you’ll get a variety of things such as:

- How to build your business credit

- Which cards to apply for

- The intelligent ways to stack your credit

- And get approved for large sums of 0% interest money and more

Here’s more you’ll get with Jack:

- Expertise. You will get to learn the skills from the Experts to become a credit expert yourself. Jack and his team have tailored this course to help you get the highest credit spending limits fast.

- Community. So you don’t have to do this alone, there is a community of like minded people and the Credit Stacking community is dedicated to helping all of its members win. You can take the lessons learned and start credit stacking right away.

- Content. There is a top notch production crew to enhance the footage of the content and message, to learn through high quality videos, graphics, and real-life applications.

- Mentorship. You can reach out and talk with Jack and other credit experts on a weekly Q&A

- Resources. There’s a wealth of knowledge and resources available whenever you need it. Plus, there are weekly updates and newsletters to continuously keep you “in the know” with all the new tricks of this trade and what changes in the landscape.

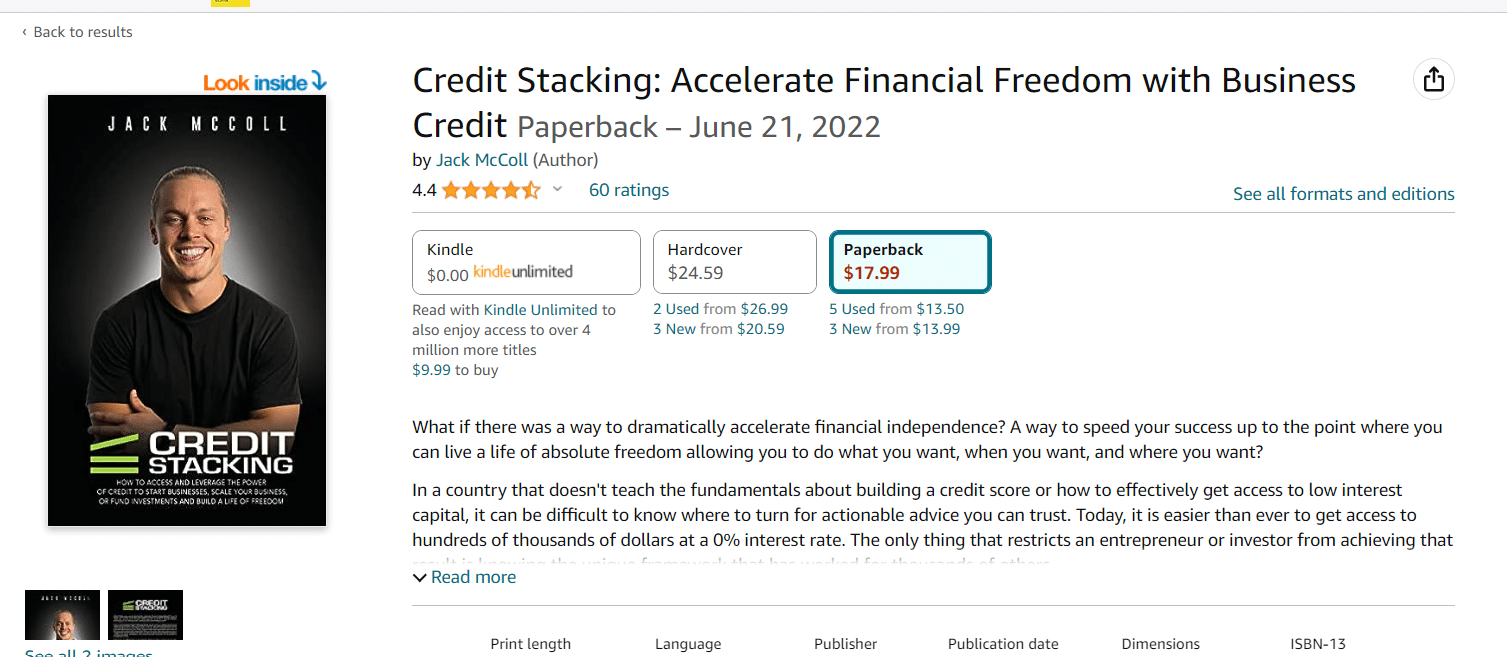

Jack’s Book (Credit Stacking)...

Did you know Jack has a book on Amazon on Credit Stacking which breaks down the Exact steps that he used to go from zero business credit cards to getting approved for over $500k in credit in just over 12 months?

Here’s more:

Recent Features

As per the website, there’s been features for the following:

- Forbes

- Entreprener

- Yahoo Lifestyle

- Bloomberg

- USA Today

Here are more numbers:

How Credit Card Stacking Works In General (Step-By-Step)

Wait no longer in getting your question “how does credit stacking work” answered by hearing this…

There are different steps in the process depending on the client, provider, process and more but in general here it is:

STEP 1: You will get your personal credit scores accessed by a credit card stacking company to best determine your current credit parameters in terms of current credit, aged history, revolving accounts, income and many more parts to see if you’d meet eligibility requirements and to best see which cards you are most likely to qualify for.

STEP 2: The credit card stacking team and company will assist in helping you apply for multiple cards, generally it starts with the larger banks to get the Max amount and a greater overall ROI from all parties, and the amount of cards can vary depending on each person but it’s common to see 4-5 cards at once be considered and approved for. You can even see more submissions after 30 days to repeat the process…

- The cards applied for vary on many things but to this correctly without messing it up, your credit needs to be pulled from the right credit bureaus as each bank, regional bank, and community credit union you see pull from different bureaus. You even see 3 different banks/locations from one credit bureau be pulled and access to multiple products at once and or one credit bureau pulled from each bank in different multiple locations and more.

STEP 3: Once you get the cards, you can use them for what you need and you’ll be shown how to liquidate the cash out of these cards in multiple ways even without the cash advance fees

So it depends on each person’s credit profile what someone could get and the projected ranges from minimum to maximum but to better improve your chances on getting issues Max credit and bettering your approvals are with things like:

- Having 2+ open revolving accounts and there are also other parameters than just that you’ll learn more about in time but also this…

- 720+ credit is best but having 700+ credit on ALL 3 consumer credit bureaus is usually the starting point for credit card stacking, otherwise if you have less than 700 on all, one or two of the credit buraueas, it’s not to say you couldn’t get cards but they are likely lower limit and or just one or two cards without the credit stacking direction

- Don’t have any late payments in the last 2 years, no charged off accounts

If you’d like to learn ALL the credit requirements to credit stacking and my #1 recommendation where I’ve helped out plenty of people get enough in credit lines strategically while also getting acces to other funding opportunities, please see the button below:

Credit Stacking Reviews

Here's what other people are saying about Credit Stacking:

How Much Does Credit Stacking Cost?

The company does not show the costs of their membership but from sources on the Credit stacking jack mccoll cost it’s likely up in the $4,000+, $4,500+ range, and here’s what you get to choose from:

- Business Credit Accelartor:

- You get access to course content for Life…

- Six months of weekly coaching calls included…

- Lifetime support on the Facebook Community…

- Access To Support Staff

- Business Credit Pro:

- You get everything from the Business Credit Accelerator plus:

- Additional “Pro” course content…

- Personal Credit Analysis Gameplan…

- Monthly Zoom Coaching Call that takes place every 3rd Tuesday of each month at 4pm AZ time)

- You get everything from the Business Credit Accelerator plus:

P.S If you’d like to see an alternative and Free Business Credit Building Video Series up showing how to get up to $150,000+, see here:

Who Is Credit Card Stacking For?

Credit Card Stacking is for people who want access to a community of like minded indivudalas and to leverage the network Jack has and not having to figure it out on your own, as well as:

- For starters with startup businesses or for those who are starters with existing businesses wanting to get step-by-step content to building a long-term sustainable business with business credit

- Business owners who have an idea and want to fuel it and ain access to incredible amounts of business credit over time and tap into 0% interest funding

- Non-startup business owners and entities that want to continue to further their growth and want more than just the top tier banks credit and are looking for regional and community credit unions and more

- People who don’t mind spending money upfront to get access to course content and want the added support through coaching calls, and additional course content, along with more

- People needing alternatives to cash advance revenue-based services with higher interest and cash-flow sucking services (this is per case basis, as it depends on how you use the funds at the end of the day)

- You’re experienced in credit stacking and just want to know what else is out there and be kept up to date

Who It’s Not For?

- People very experienced in credit card stacking who are not looking to buy into a course, or it can also go the other way like I said before - if you want to get access to more content to help you along the way

- You don’t want to spend a bit of money up front to just get in and get started

- You’re looking for a faster set up without upfront course costs and are just looking for a success fee on the backend where it applies to the total credit lines issues

- You’re looking for an alternative and from someone that also has a great amount of experience, and not only in credit stacking but cash-flow based (revenue-backed), collateral, and business trade credit as well for the longer-term strategy to scale and get access to more funds as well as for the difficult times

Pros and Cons:

Pros:

- Access to course content that you can't just get anywhere and you'll get a handheld way of getting to your ultimate outcome

- You'll get access to Jack's network and get into his personal relationship managers to help you leverage getting more funding and over time

- Strong community of many entrepreneurs you can even bounce ideas off of and grow together so you're not alone.

- Personalized credit analysis gameplan so you can really know what to work on, and go after

- Coaching calls access to get tailored support to your needs so you don't have to make endless mistakes time and time again that only trap you on a hamster wheel or rabbit hole you're squeezed into tightly and can't get out of without a hand.

- Proven results and success from students and many others

Cons:

- I wouldn't say this is a con but too many it could be which is the costs to get going. People with a high enough standard (or looking to get there) to invest in themselves will.

Alternatives

There are plenty alternatives out there and those that you don’t have to pay for upfront and still get enough educational and up to date content, but for an alternative that has an upfront cost first is

- Business Credit Workshop

- Credit Line Hybrid (Recommended)

For Free alternative content:

If you’re interested in picking up a Free business credit building video series to help in acquiring credit lines and from different locations, you can see that course here:

What I Liked Most About Credit Card Stacking

If I had to pick just one thing I like most about the course, it would be the ongoing support they offer as well as guided support with six months of weekly coaching calls. This is helpful to have along the way so you can continue to credit stack and doing it correctly. I also like that it is reputable and has a strong presence in helping people.

What I Liked Least

I’m not a fan of buying into programs and courses when there’s plenty of information online but there is exclusivity and not everything is shared online but also the costs upfront and then if there’s a setup on the backend with a success fee for helping you get funds, there could be an additional on top of that.

Nonetheless, I Believe a course like this is beneficial for the write person, the one who needs hand holding to then spread their wings and get ongoing support.

Final Thoughts And Next Steps…

What was your favorite part about Credit Stacking? Did one thing stick out more than the other?

Whether you’re looking for a strong community of like minded individuals in similar and different parts of their journey or the Top notch content you can only find with Jack’s course or the ongoing support from the team and more, you can get a bit of all that - But you need to address this first…

Is it Right for you? Or better yet, have you explored the alternative(s)? Before making an investment in terms of money into anything, think about the change you Truly want, think about the places you could be if committed…

But more importantly, what your real needs are. Everyone’s always looking for 0% interest no doc loans, no doc lines of credit and more, and through 0% interest credit lines is an Exceptional way to go…

You’ll be able to free up your cash-flow, allow yourself breathing room to have fully functioning and efficient operations while getting some time back for yourself to enjoy your business more and even further is this…

Your own health and relationships, as you’ll see the difference in your character and build yourself up while your business grows at the same time. If you’re interested in seeing Jack’s course, you can see here, but if you’re interested in seeing my #1 recommended alternative with the free Video series, please click the button below to get started