How would you like to get up to 5,000,000 in working capital within less than 24 hours or up to $50,000,000 in Real Estate Financing Without a hassle…Even if you are a complete beginner?

Welcome into this GoKapital Review post where I “Michael Granados” a small business owner like yourself will pulling back the curtains to show you EXACTLY how GoKapital operates day-to-day. The pros and cons, alternatives and so much more so you can finally put a stop to feeling down and out in your business, from going to bed at night wondering if you’ll ever get funding, and even worse - Having to close your doors down!

Listen, There are no shortages of Funding platforms on the web (I’m sure you’re well aware), but there is a HUGE shortage (over 80%) of small businesses being turned down by the banks for traditional financing because you don’t have the “right revenue”, or the best credit, collateral to put up, the time in business and much more. But luckily there’s a solution…

GoKapital can help you get faster funding without a hassle so you can get back to building, growing, expanding, and even getting out of a tight pinch. I’ll show you how right now.

By the way, "Is GoKapital Legit?" Yes, 100%.

What Is GoKapital?

GoKapital is a business funding platform offering you and all business owners alternative working capital solutions and Real Estate Financing through their various lending products you can get your hands on. With GoKapital you can get this almost “All-in-one” business funding program with all types of products ranging for all types of businesses and needs. Since 2013, GoKapital has helped Hundreds upon Thousands of businesses succeed.

Why GoKapital?

For one, we leverage technology to simplify and expedite your search for commercial funding and we make your application process super fast and simple as possible. Through the working relationships with multiple private lenders and a knowledgeable team of advisors, GoKapital without a doubt offers more funding options and better approval rates than your local bank.

Another amazing aspect is that the team of GoKapital consists of seasoned professionals with diverse backgrounds in:

- Finance

- Technology and

- Entrepreneurship

These people know what it means to manage a business for sure. PLUS, it helps that the company has an A+ rating from the Better Business Bureau.

Let’s go deeper inside.

Going Inside GoKapital

I want to start by showing you the business loan products and then I’ll show you the Great Real Estate Financing part of it, okay?

For Business Loans:

There are 8 Super amazing business loan services GoKapital has and they are:

- Merchant Cash Advance

- Business Line Of Credit

- Small Business Loans

- Unsecured Business Term Loans

- Equipment Financing and Leasing

- SBA Loans

I won’t get into every specific product in the “written word” on this post, but I will try to have separate videos for each like you’ve seen up above, however, which one is the fastest type of funding?

24 Hour Funding (Same Day Approval!)

One of the fastest products to get funds deposited into your account so you can use right away is a Merchant Cash Advance/Revenue Based Loan and a Business Term Loan

For Merchant Cash Advances/Revenue Based Loans:

These are the most common and fastest approved “cash advances” and “business loans” on the market today, and have an approval rate of over 80% which means most people who apply get one. The other part advantage to this (as you’ll notice I covered this in the qualifications up above for the products) is you can get approved even if you have poor credit and:

- Less time in business

- Less Revenue

- No Business credit (or not good enough)

- No collateral needed

- No Hard credit checks

Related: Same Day Instant Approval Funding MCA Programs

Many people will think that the downsides are the shorter terms and possibly higher rates that amount to a higher payback amount, and while that can be true, here’s how you have to look at it…

- Can you get approved for a different cash advance/loan?

- Does the benefit exceed the repayment?

Both questions are equal, but the second one is more telling, why? If the benefit of taking the funding will not keep your business stable or increase it (rather decrease it), then you’ll always find excuses and problems with the interest and repayment amount.

Look, if your business for example is a restaurant and you need funds to grow a patio that’ll bring another 100-200 people per day and will increase your bottom line (income) by like another $20k-$30k, then a payment of like $5,000+ back will not really matter. BUT if you’re struggling to just stay afloat, then it will never make sense.

That’s how these Merchant Cash Advances/Revenue based loans work.

For Business Term Loans:

This is the most common type of “understanding” people have when it comes to getting a business loan because they have:

- Longer terms

- Monthly payments

Anytime you hear a business term loan, you connect them with SBA Loans which are usually the first line of defense…If you can’t get an SBA loan, then a business term loan is an alternative approach, and then on and on it goes.

Now let’s look at the Real Estate Financing Services

For Line Of Credit

How would you like to get up to $55,000 that you can use Whenever and however you'd like in your business and get 6, 9, or 12 month terms to help you along the way?

Unlike a "term loan" or a cash advance/business loan where you'd get a lump sum and have an expected time frame to pay it back, with a line of credit you get to withdraw the funds and use them whenever You need them.

Here are the qualifications:

- You must have 2 years in business

- $20,000 in Monthly revenue

- 550 Credit Score

- Max 3 existing business loans

Benefits:

- Pay only for the funds you use

- Weekly repayments

- 24 hours approval and fast funding

- Minimal documents needed

- Draw your business capital at any time

- You get early payment discounts!

- You get an online portal to access your funds

- Pay off your existing debt

For Personal/Startup Loans:

What could you do with an amount between $20,000-$500,000 with lower interest rates and longer terms?

The personal and Startup business loan is a GREAT Addition and even an alternative to medium-high rates you'd get with other loan products like the Merchant Cash Advance and even term loan products without collateral. Here's what to expect with the personal and startup loan as they are similar in terms of qualifications and requirments...

Qualifcations:

- $50,00 in annual revenue (Taxes or Paysubts verifiable) And ALL of the following...

- Zero (0) time in business BUT requires you have at least 5 tradelines on your personal side

- Minimal Recent Inquiries

- Strong Credit History (Creditworthiness)

- No Recent Negative Items

NOTE: Too many NEW Tradelines and other unsecured (non-collateralized) loans you just received can reduce your amount or completely decline the file because this is based on your debt-to-income ratio (DTI).

Documents required for pre-approval:

- Fast On-Line loan Application (below)

If you get approved:

- Drivers license

- Bank Statements

- Tax Returns

- Pay Stubs

- Utility Bill

NOTE: The origination fee is 15% which I know sounds high, but that's how the lenders compensate themselves, by offering you a low interest of 6%-18% with monthly payments and terms from 1-5 years. The amount that needs to be fufilled and effort it takes on our behalf is something you need to consider and the rates you get are usually better than anything else out there and compared to the alternatives like a Merchant Cash Advance for one...

You get better terms and rates that easily makes up for this. And you have to keep in mind the benefit exceeding your repayment and how you'll use your funds to potentially double, triple, quadruple your revenue and or perhaps save more and keep your business afloat.

Don't meet these credit requirements and possibly have bad credit AND have business bank statements to get funding with? Click here to see my #1 Recommended Up To $2,000,000+ Alternative

Real Estate Financing Products and Services

- Hard Money Lenders

- Loans For Investment Properties (Rental Properties)

- Commercial Real Estate Loans (CRE Loans)

- Bridge Loans

- Foreign National Loans

- Mortgage Loan

GoKapital Industries Served

Here’s a list of the industries GoKapital helps:

- Cannabis Business Loans

- Retail Store Financing

- Dental Practice Financing

- Restaurant Financing Options

- Loans for Accountants

- Truck Financing

- Auto Repair Shop

- Construction Finance For Builders

- Healthcare Finance

- Transportation Financing

- Gun Shop Business Loans

- Loans For Funeral Homes

- Medical Financing

- And Much Much More!

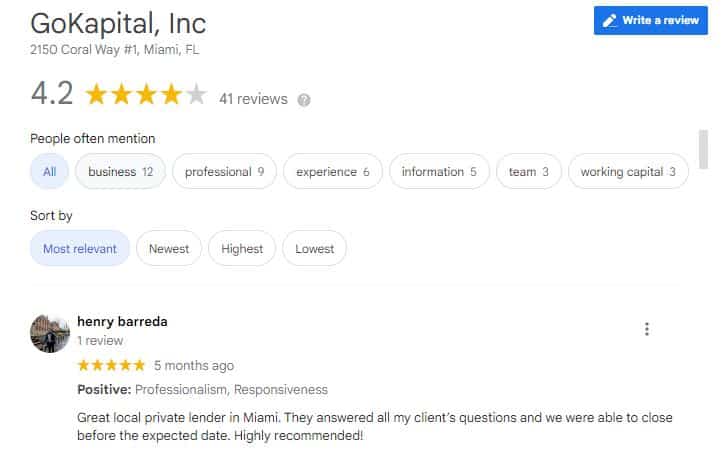

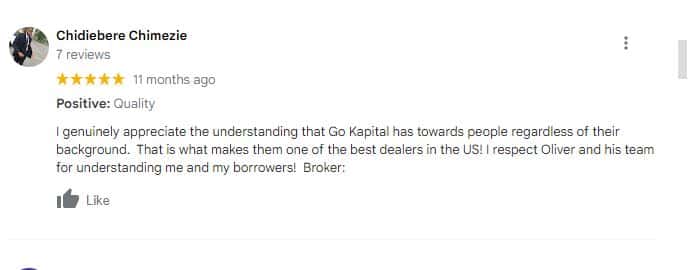

GoKapital Reviews

Starting with Google here are some gokapital reviews:

Here are GoKapital Truspilot reviews:

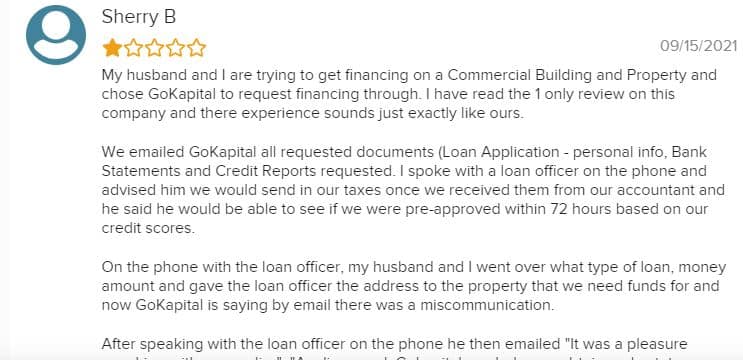

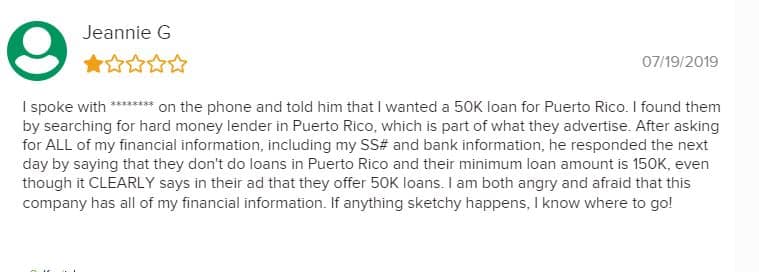

GoKapital Complaints

The following "complaints" are really not "complaints" rather you'll hear people who either didn't properly read the qualifications/details of the program/services or for some reason are not happy but...

Here’s what other people had to say about GoKapital:

GoKapital BBB

Like I stated earlier in this post, GoKapital has an A+ rating from the Better Business Bureau, check it out:

How Much Does GoKapital Cost?

There is no cost to start an application and usually get a soft credit pull so it shouldn’t cost you your credit. There are no hidden fees to worry about but there is one thing you should be worried about…

Your time and energy! What do I mean? If you feel like you don’t qualify or if it’s the best type of funding for you, then don’t waste your time going through it only to find out you didn’t get approved or regretted starting the application process. But it never hurts to check.

Who Is GoKapital For?

GoKapital is made for ALL types of business industries and business owners who want lightning-fast business funding and want access to this “All-in-one” approach where you can get help with just about any and every business loan product or real estate financing product.

Here’s more:

- Beginners looking for fast cash and want same day instant approval funding and would like to have as many options on the table to choose from

- Intermediate and expert level businesses who’ve received funding in the past and would like more of it and or with a different company.

- Small businesses who are looking for an SBA loan and you couldn’t get approved for the SBA EIDL (or got it and want more), the PPP Loan and you don’t want to miss out on funding this time

- You want equipment financing/leasing so you can get the right equipment injected into your business at last

- You don’t want a lump sum of cash and would like to withdraw from your account whenever you need the money with a business line of credit

- You’re looking for a personal/startup loan and need help getting funded faster.

- You want longer terms with monthly payments

- You’re a real estate investor looking for the right funding with the best lenders

- And much more!

Who’s It Not For?

- 100% startups with no revenue generated at least in the year

- You want accounts receivables financing

- You don’t need alternative funding

- You don’t meet certain revenue/credit/time in business requirements from some of the products

Pros and Cons

Pros:

- All-In-One Funding platform so you can have multiple options in funding to choose from which means you'll always have an option for you no matter what your needs are

- Super Fast Funding times in all 50 states and even in Canada so you can get approved much faster which means you'll have your funds deposited into your account quicker than going through a traditional bank (or another loan program)

- Phenomenol and High Standard business loan and real estate financing services so you don't have to worry about getting the best service and funding possibilities available which means you'll always be taken care of and put first.

- Superior Customer Service so you can have a delightful experience without being hassled which means you'll actually enjoy the process of going through the application process and getting funded with ease!

- Extra Tools and Resources so you can use the Loan Calculator and guidelines to see what you can get approved for which means you won't go into your application blind folded

Cons:

- Higher Merchant Cash Advance Revenue Qualifications

- Unsecured business term loans are only offered in about 30 states

- Doesn't do accounts receivable financing

Alternatives

There are plenty of alternatives on the market today with different sets of requirements but GoKapital has some of the highest standards to business funding so what you’re getting with them is one of the best. But if you’re looking for an alternative to a Merchant Cash Advance with a more “hybrid” approach, then I recommend this company who can help get you:

- Up To $2,000,000

- Business Capital With National

- Hello Skip (Government help)

I love this up to $2,000,000 program for their “hybrid” Merchant Cash Advances which is 50% less expensive than a traditional merchant cash advance, you get more flexibility, great early pay discounts, flexible terms, and they don’t carry interest rates (seriously), no hard credit checks and no collateral.

PLUS: They have a great program where you can get up to $25,000 same-day instant approval with just $5,000+ per month in revenue (already far less than with GoKapital). As well as 1099 gig worker funding, a line of credit and much more. You can check out by clicking the following button:

Aside from the $2,000,000 program, Business Capital With National is great and also if you're looking for accounts receivables financing where you can give up unpaid invoices as collateral to get funding, I would recommend Business Capital With National

What I Liked Most About GoKapital

There are SO many things to pick but If I had to choose just one, it would be their superior products that set the bar high. I really Love how there are A LOT of options to choose from and in case you didn’t like one service or you felt like it wasn’t the right fit, you may have another one to choose from.

You also can feel comfortable you’re being taken care of by the support team and whichever service you need, you’ll be handled with care and a very welcoming approach.

What I Liked Least

Hmm, I wouldn’t really say there’s something I liked least and I’m not saying this to be biased but GoKapital really delivers every part of their program exceptionally well. I mean, if I had to entertain the fact that I should choose something…

Maybe some of the higher requirements to certain products. Like the Merchant Cash Advance, you have to be doing $30k+ per month and you may not have that amount in revenue and need an alternative. That’s Why I spoke about checking out the up to $2,000,000 program

Final Thoughts

Which part about GoKapital was your favorite? Listen, there are a Ton of lending companies on the web, and I’m sure you’re well aware of all the phone calls you may be getting, emails finding their way into your inbox, text messages, etc…

But one thing about many of these programs that don’t compare with GoKapital is that we don’t annoy you. We will give you breathing room to be yourself and not stress out, we will follow up with you appropriately and with care to make we understand you and your business needs so we can properly communicate with you.

The “GoKapital Way” will help you obtain the working capital you need to finally power forward and or real estate financing very quickly so you can get your next property at ease. And whether you’re looking for $100,000 in working capital or $1 Million for a cash-out refinance, we have the right loan program for YOU.

So If you’re ready to get started with GoKapital, you can click the button below to either get a Business Loan/Cash Advance Or Real Estate Financing or if you'd like my alternative to get fast funding with less requirements and even get same day instant approval funding, click here to see the up to $2,000,000 program.