Would you like to get up to $250,000 easy to use business credit funding and be shown how to access these high-limit cards as “cash lines” of credit, eliminating the cash advance fees?

How about getting a 12-month done-for-you funding membership and 0% Interest for an average of 12-18 months?

Welcome into this In-depth Fund and Grow review where I “Michael Granados” a long-time business owner who knows what it’s like to receive funding as well as a Business Loan Broker Expert (owner of Viral Funding Solutions Too) will be pulling back the curtains to reveal the TRUTHS on Fund and Grow’s operations, the pros and cons, alternatives and much more but first….

I’m no mind reader but are you thinking of this question: “Is Fund and Grow Legit” or similar? Here’s the answer to that…Yes, 110% Fund and Grow are legitimate, HOWEVER, that does NOT mean they are BEST for you so you’ll want to stick around until the very end of this post to REALLY know if it is or not and how to finally power yourself and your business forward with maximum funding without making mistakes to get it and losing out.

Alright, let’s get into it.

What Is Fund and Grow?

Fund and Grow is a funding organization that helps business owners of all backgrounds and sizes get access to up to $250,000 of unsecured (safe) business credit cards and shows you how to access these cards as cash lines of credit which eliminates the costly cash advance fees (merchant cash advances). They focus on stacking multiple business credit cards and keeping your credit lines at a 0% rate longer-term.

For over 14 years, Fund and Grow have helped over 30,000 business owners get access to over 1.4 BILLION dollars of business funding. The owner and CEO of the company is Ari Page who is well-known in the space of business credit and business credit lines.

Fund and Grow is somewhat similar to another program I reviewed in “Credit Suite” (which I use more of) and they have what’s called the “Credit Line Hybrid” and you can use multiple business credit cards as well and liquidate the cash out of the cards and use them for several investments.

The difference between the two is that Credit Suite is I believe more flexible with startups (as well as non-startups) and many more businesses because they also help build and establish “Trade Credit” with a more done-for-you software that shows you this:

- How to set up your business to meet fundability so you look attractive to lenders...

- You get to set up and activate your D-U-N-S Number...

- To get initial Trade Credit so you can build your business credit in multiple ways and your business credit reports with no personal guarantee...

- Get your business credit without a personal guarantee...

- Free Business Finance Assessment...

and not just the credit lines like Fund and grow focuses on BUT it's not to say Fund and Grow don't do other things because they do (they have loans and other departments). While fund and grow also does work with Startups technically, Credit Suite focuses on it even more and establishing business credit in many ways as well as getting access to other credit-based funding and others like even 401k/IRA, stock-based funding, and other ways to connect you and are constantly evolving their partnerships.

Related: Fund and Grow Vs Credit Suite

Why Fund and Grow?

Aside from having a dedicated team of 65+ for faster funding and being on the Inc 5000 for 7 years in a row with a BBB rating of A+ and so on, they have the results with their tested and proven program. Here’s more:

- You get a done-for-you credit card stacking membership so you can get proper guidance from myself/the team and be able to work with you directly to create hundreds of thousands of available funding that you can keep at 0% interest rates for longer-term

- All the legwork is handled for you, including providing regular updates, and the Fund and grow team stays in close contact with you and the banks so you’re not required to do any of that work - except activate using your funding

- You can even get up to $100,000 in corporate credit without a personal credit check, and will not affect your personal credit score.

- LLC creation is supported

- And you get to optimize your credit portfolio once and for all so you don’t have to worry about getting less than what you deserve

Let’s go even deeper inside now.

Going Inside Fund and Grow

In case you wondering if Fund and Grow just give you a “List of credit cards” to apply to and that’s it (so why would you need them), that’s not how it works, rather like this…

The team gets the cards for you. Sure, you can take the time to research this and “Try” to do it yourself but in my experience (Believe me, Truly), it’s NOT that easy to just walk into a bank or apply online or think you’re doing it right…

This takes precision and you First have to optimize your personal credit profile and IF you are a business owner with time and business and the portfolio built in your industry, you have to present yourself well and leverage your experience to get maximum funding.

I’ve Literally helped out business owners/real estate investors of all backgrounds, shapes, and sizes understand that this takes certain steps before you go to the bank. Before we get into the program details and “How it all works”, let’s break down the “Benefits”...

Fund and Grow Benefits:

- You get 0% interest. You get to enjoy 0% introductory APR for an average of 12-18 months

- The credit does not appear on your personal credit report. This unsecured (safe and no collateral) business credit you obtain will not show up on your personal credit report so you get to differentiate/separate from your personal and not be held liable for your personal assets in the case you ever have a problem in your business and you’re not protected

- You get Cash-Like Purchasing power where you can utilize the funding You receive for ANY business/real estate need you literally desire without restrictions like certain bank loans or even non-banking loans require. You’ll know how to send wire transfers from your business card to purchase real estate for as little as a 2.8% wire fee. And there are no fees when simply swiping and purchasing using your business credit cards

- Unsecured Safe Funding at your fingertips which means you’re NOT risking your hard-earned assets, such as properties as collateral (home and investment properties). Additionally, you won’t give up any equity/stake in your business and or ongoing real estate deals in order to access and use the unsecured business credit meaning YOU maintain 100% control of your business and the credit lines no matter what

- You get up to $250,000 in Unsecured funding. As a client you can expect to get up to $100,000 or more of spend-like-cash Unsecured business credit in 45 days or less and up to $250,000 over the next 12 months, depending on your creditworthiness.

- You get up to $100,000 in corporate credit with the flagship Do-It-Yourself corporate credit program that will get you $100k or more in unsecured, NON-recourse corporate credit over the next 12 months.

- So this credit is not tied to you personally, there is no personal credit check required, and will NOT affect your personal credit score. Instead, this credit will BOOST your Dun and Bradstreet corporate credit rating and eventually allow you to access hundreds of thousands of dollars of NON-recourse funding, which is hte Ulimtate safest form of corporate funding.

Here’s What You Get Inside…

When you get access to the Fund and Grow program here’s what comes with it:

- 12 Months of One-on-One Unlimited coaching and Credit Building (Including a Secondary Applicant). The Fund and Grow team (and I) will work with you and coach you directly to build up your credit score so that you are finally more credit-worthy and eligible for the largest funding approvals. You even get coaching for a secondary applicant of your choice which means you’ll have more flexibility and help.

- Up to $250,000 of Growth Capital Completely Done For You. The Fund and Grow experts will complete multiple applications and carry out negotiations on your behalf to secure you multiple batches of funding. This is completely managed by the team/us and is a complete done-for-you service which means you can kick your feet right on up to your coach (or favorite seat), sit back and relax and watch your approvals and money come on in much faster and smoother.

- Advanced Credit Consulting to FULLY Optimize Your Credit Portfolio. We/I will work with you and coach you directly to maintain and improve your overall credit portfolio so you can have a greater piece of mind knowing that your credit is being managed properly.

- You get up to $100,000 of Corporate Credit Accounts so you can safely secure up to $100,000 in 12 months of NON-recourse funding, no personal guarantee or credit check whatsoever

- Learn how to “Creatively” Leverage Your Credit In Unique Ways You Would Have Never Of Thought Of But Will Know You Needed. You will get a step-by-step explanation of how you can use YOUR Credit to send wire transfers and utilize it in credit situations where you would typically need cash.

- Entity Information with a Tax ID. You get the entire setup of the perfect entity that has instant seasoning and is in a safe lendable industry (NAICS codes) so that you can receive the largest funding amount in the shortest period of time which means you’ll be crushing it in your industry and overwhelm others with your presence.

- LLC Creation. You will get assistance in incorporating your day-to-day LLC and get you set up for receiving maximum business and corporate credit.

- How To Remove Credit Inquiries. You will get step-by-step on how you can easily and quickly remove credit inquiries from your credit report to get you ready for ongoing business credit approvals.

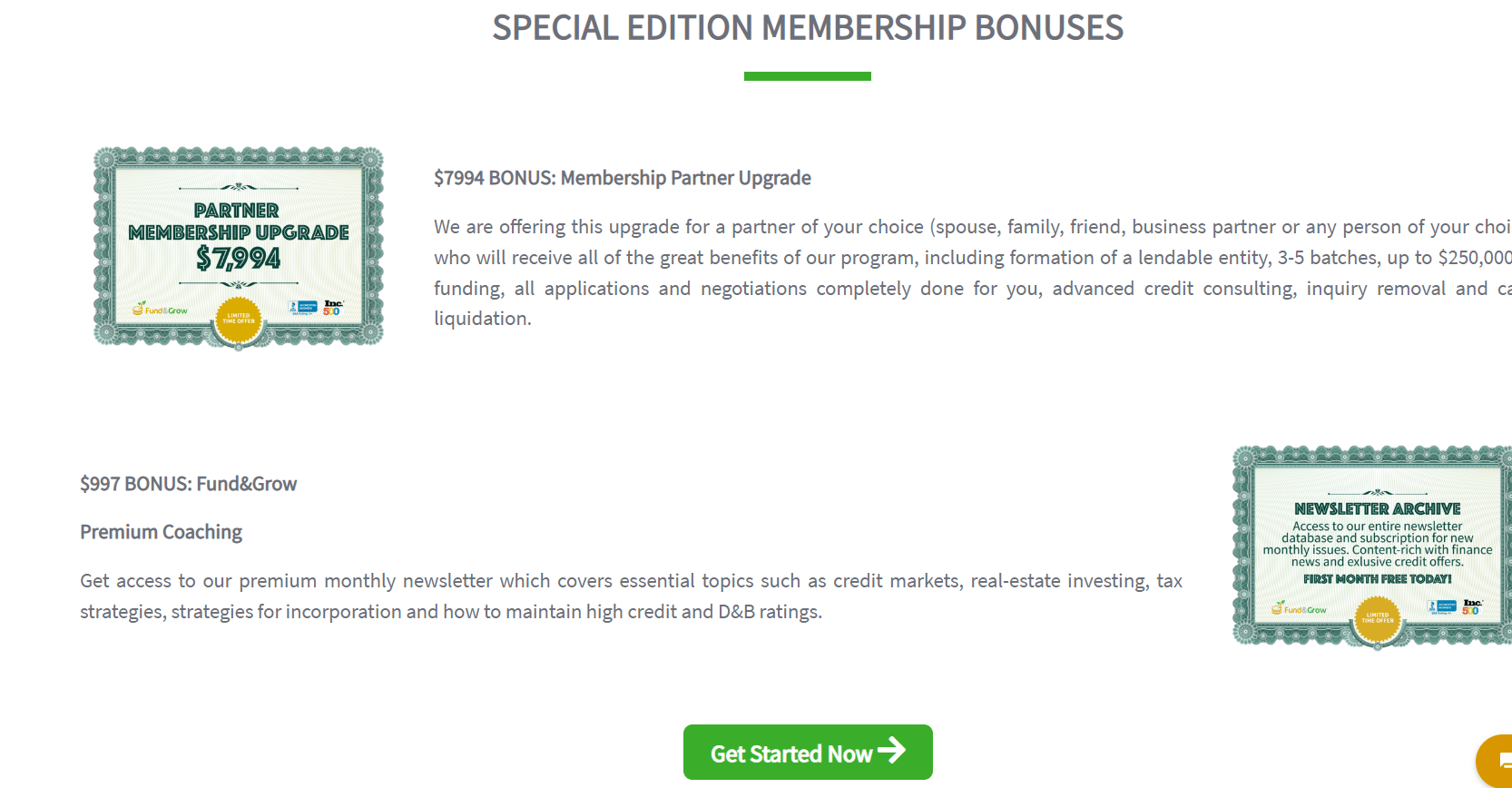

Is It okay if Fund and Grow Over-delivers for you? Here are some special edition Membership Bonuses:

- Membership Partner Upgrade (Valued at $7,994 but yours for less than that). You will get the upgrade for a partner of your choice (spouse, family, friend, business partner or any person of your choice) who will receive all of the great benefits of the Fund and Grow program including the formation of a lendable entity with also:

- 3-5 batches

- Up to $250,000 of funding

- All applications and negotiations completely done for you

- Advanced credit consulting

- Inquiry Removal

- Cash Liquidation

- Premium Coaching ($997 Bonus). You will get access to the premium monthly newsletter which covers essential topics such as credit markets, real estate investing, tax strategies, strategies for incorporation and how to maintain high credit and D&B ratings.

NOTE: In all my time in business with multiple businesses, getting your business credit right is MOST important and I wish I would have done it sooner. And Just so you know, having business credit established (vendor/Trade credit too), helps you get access to the SBA 7a/504 Loans that I’ve helped many people get. And it can get you more funding with other services too that are non-banking related.

Kaydem Credit Repair

If you need credit repair and also to qualify, Fund and Grow highly recommends Kaydem Credit Repair and here are some of those details:

- Trusted since 2008

- You get a multi-channel dispute which means they don’t just mail dispute or dispute online but do it in multiple ways

- You get to remove lates, charge-offs, bankruptcies, etc.

Of course, you can do it yourself but there’s a point where you may need the credit repair part, and let’s face it, we sometimes run into issues where there’s an issue and we can’t do it ourselves or we maybe can but it takes more time and you can cause plenty of mistakes to happen and wasted energy and time.

I also have my own recommendation in the credit repair space and a TRUE Professional with Compassionate Credit Repair you can learn more about by clicking here.

How It Works (In 6 Simple Steps)...

List of Steps

Step 1

STEP 1: You will receive a Customized Funding Plan

Step 2

STEP 2: You get a One-on-One consultation where you will go over your credit report. Here is where you will go over the common denominators that come up and how to strategically work with your report to optimize it

Step 3

STEP 3: Action Steps To Optimize Your Credit Profile (If Needed). So this is where after your credit report is checked, if it needs to be further optimized, then that will happen first so you are more creditworthy and you don’t face problems when getting access to business credit cards and more

Step 4

STEP 4: You Get To Leverage The Fund and Grow Proprietary CRM. This is where all the analysis comes up and tells the Fund and Grow team what banks are going to be most likely to lend in your particular situation

Step 5

STEP 5: You Get Inside Knowledge and get to see what the Fund and Grow team has done to get people over $25 million a month in funding for their clients. So this data is used to make better-informed decisions on how to help you get the right funding

Step 6

STEP 6: All The Industry Experience Fund and Grow has as well as you will leverage the data and other banks to help you get the best

If you’d like to see the Full process breakdown and examples of actual Credit Reports shown and where you can be losing out, click the button below to see for yourself

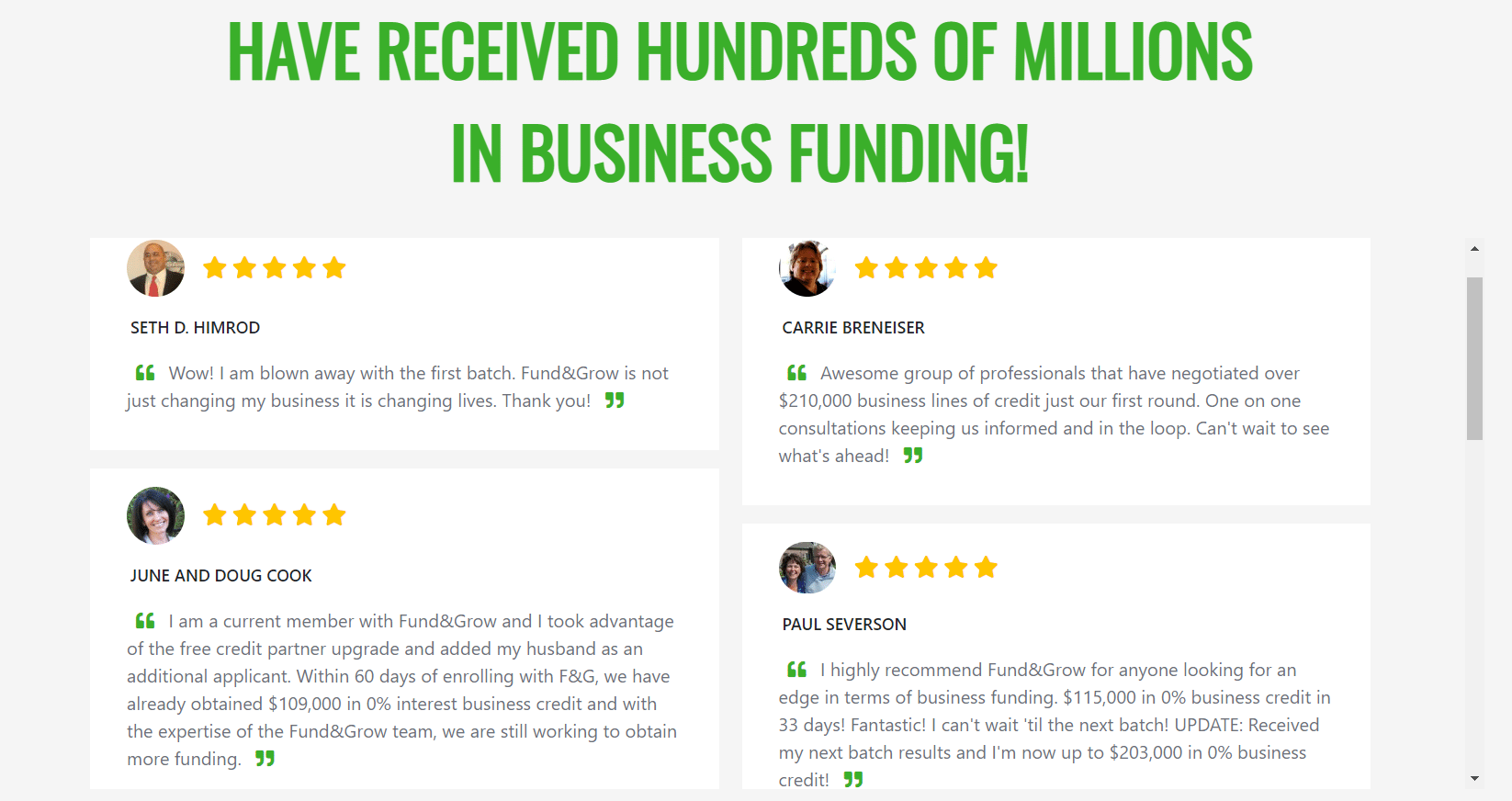

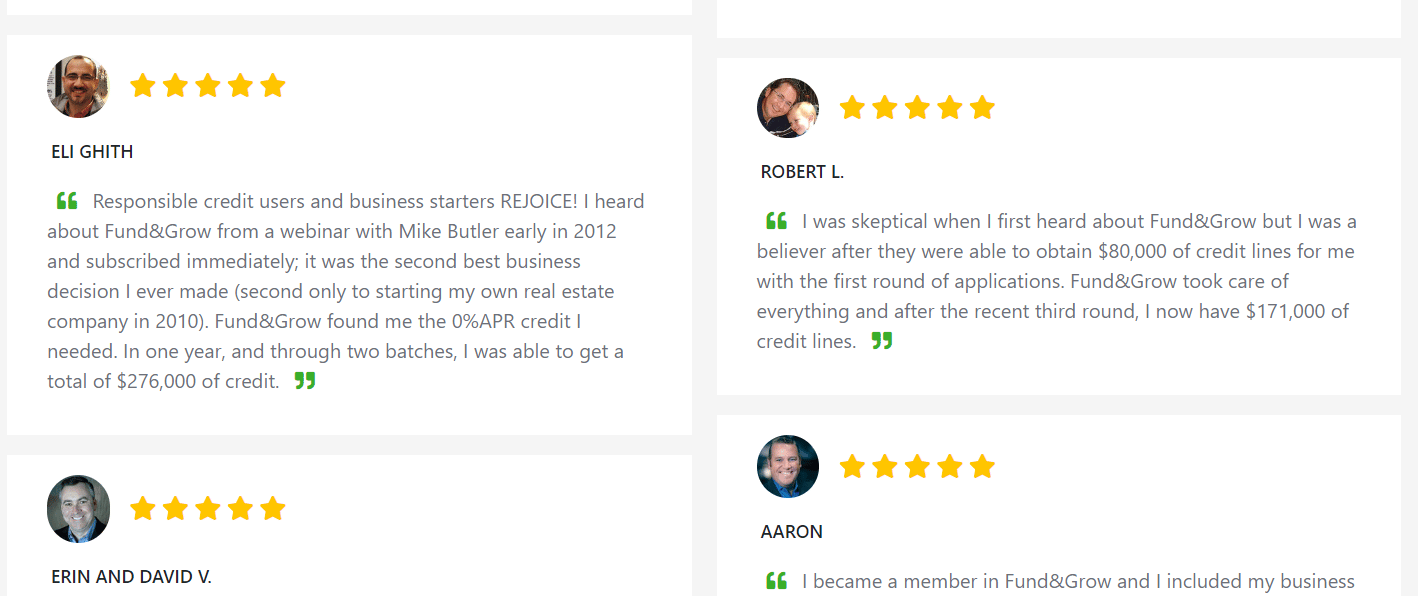

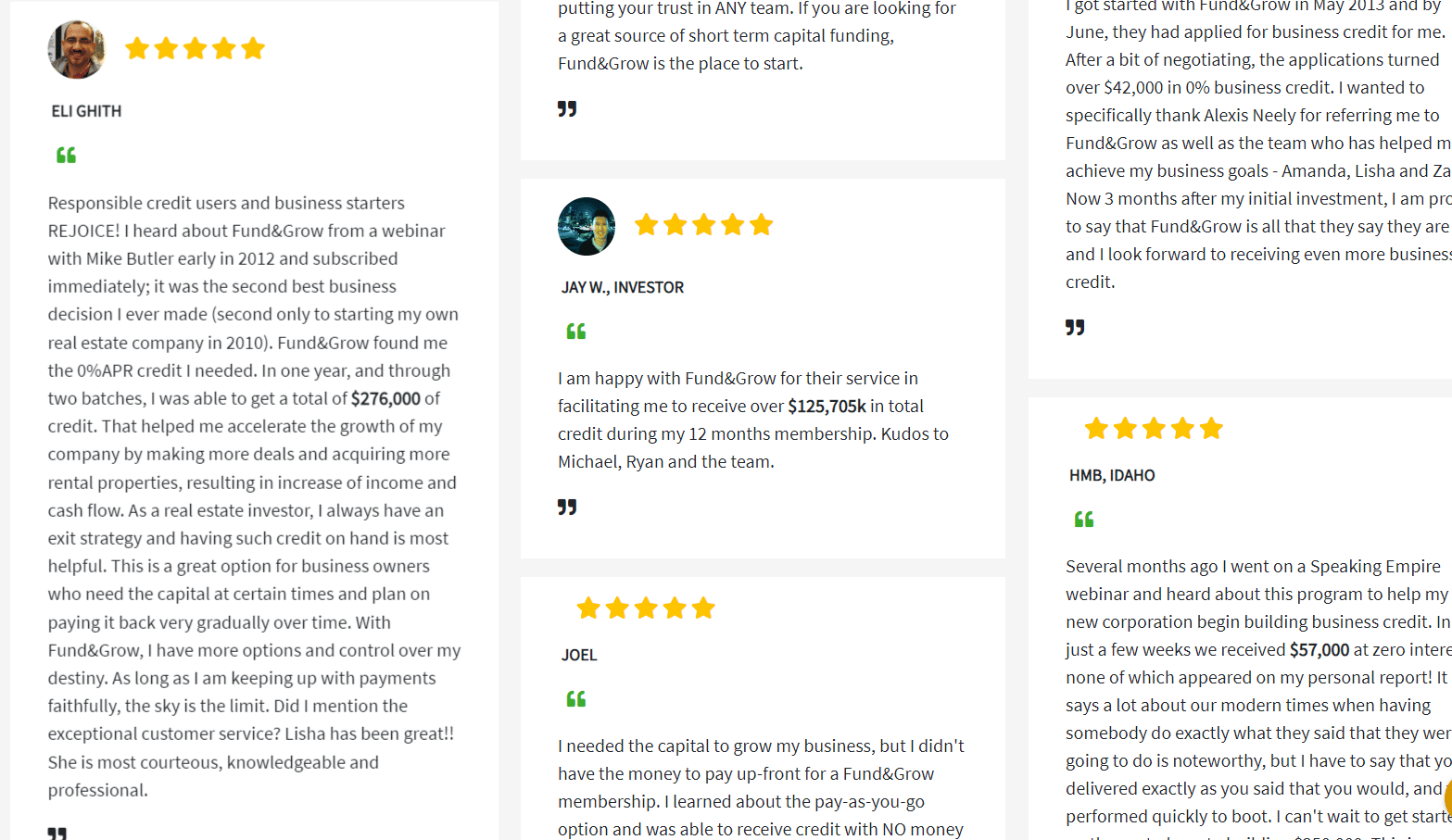

Fund And Grow Reviews

Here are some Fund and Grow Good Reviews and more...

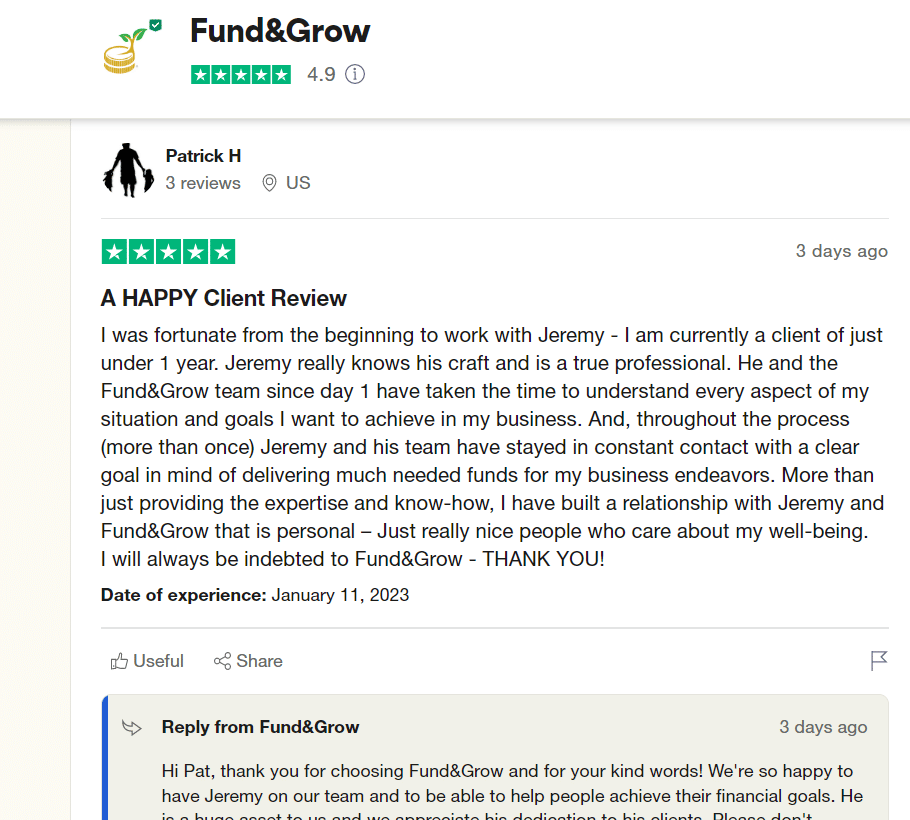

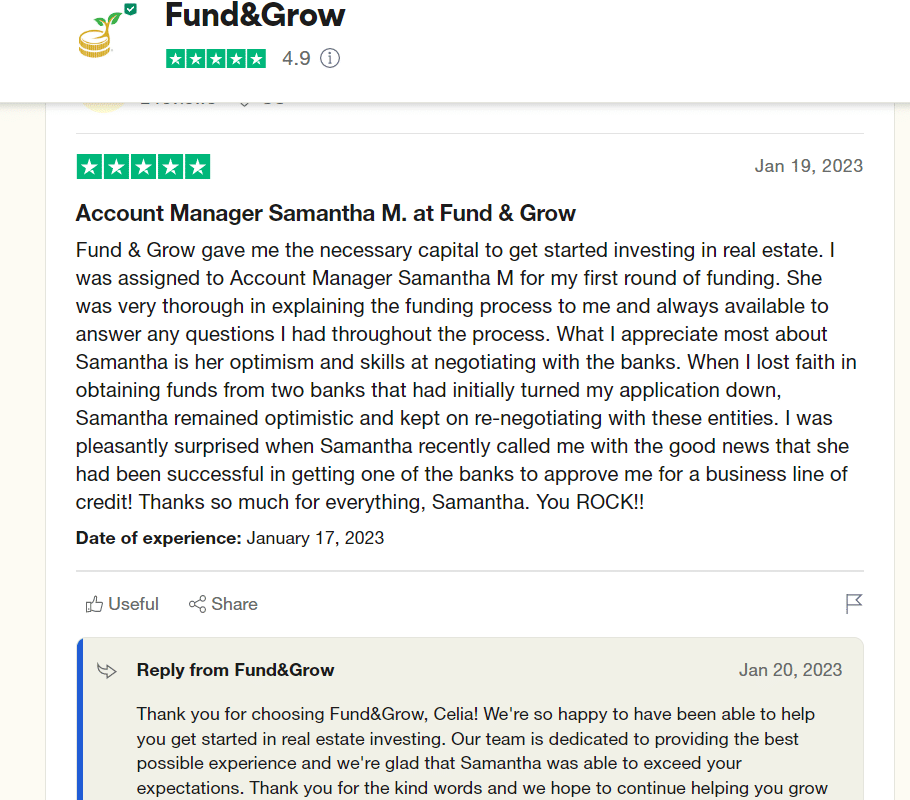

Here's Fund and Grwo Trustpilot reviews too:

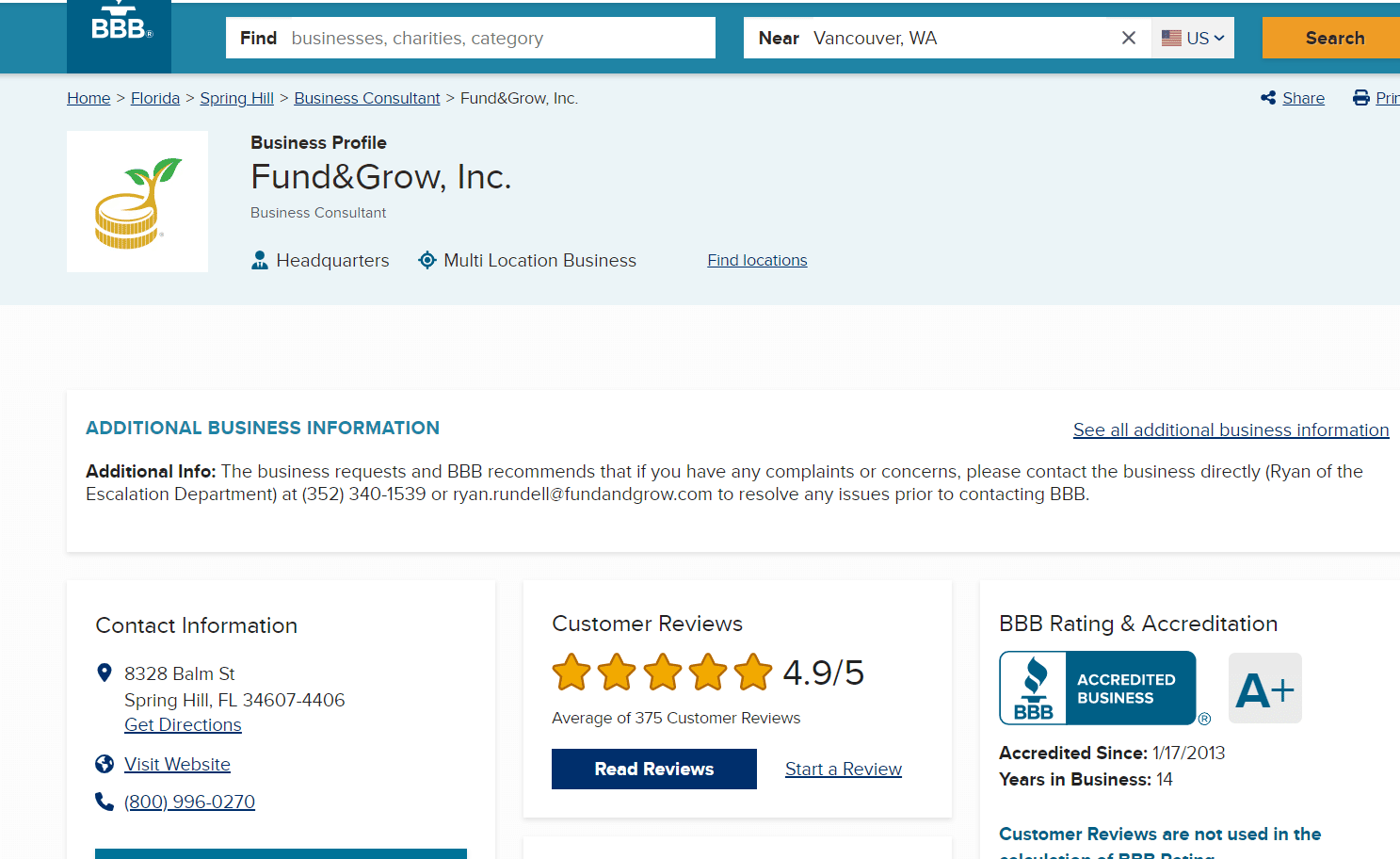

Fund and Grow BBB

According to the Better Business Bureau, Fund and Grow has an A+ rating and accreditation

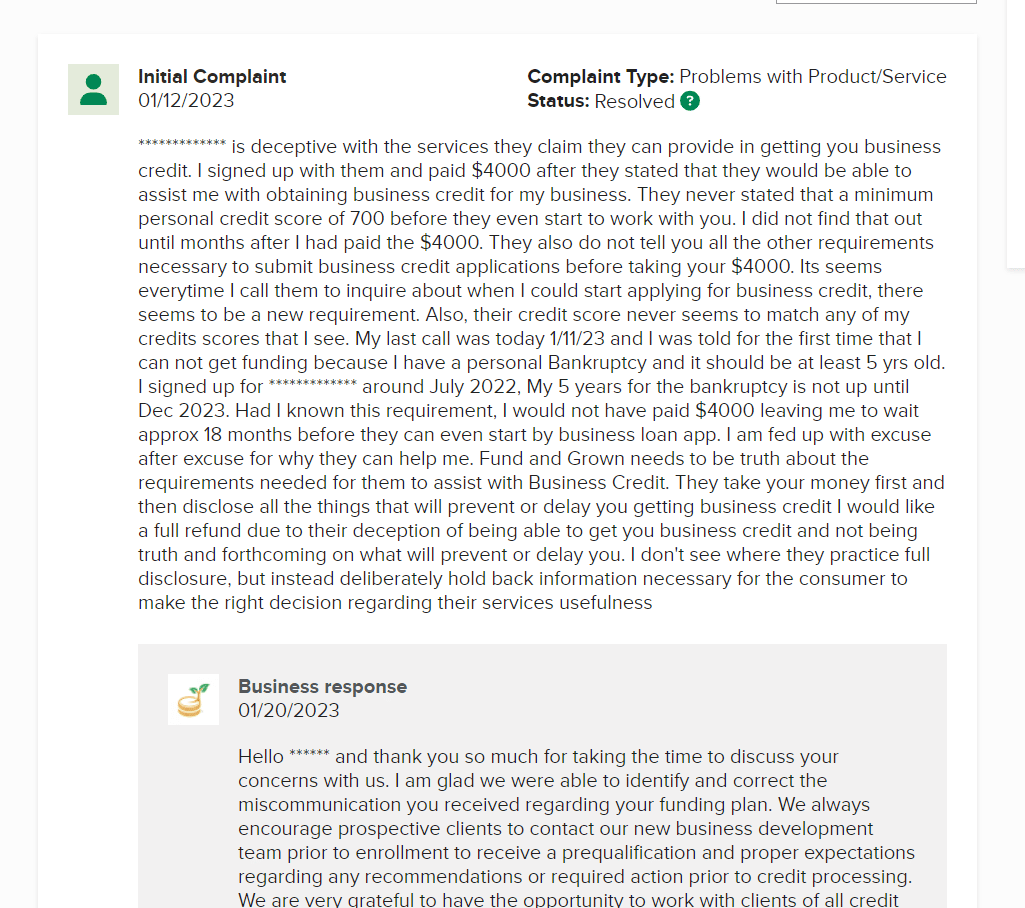

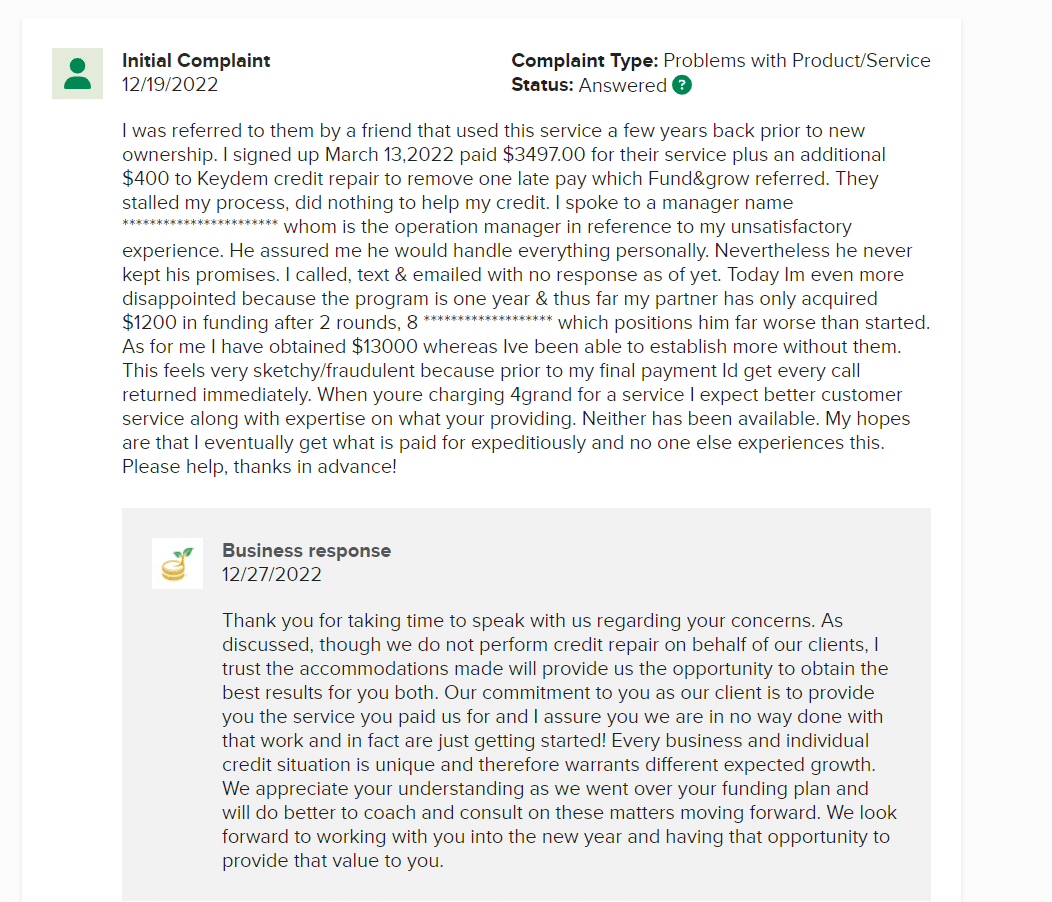

Fund and Grow Complaints

Take these complaints and Fund and Grow Bad Reviews with a grain of salt and know that it's not usually the fault of Fund and Grow but perhaps the misunderstanding/communication at times...

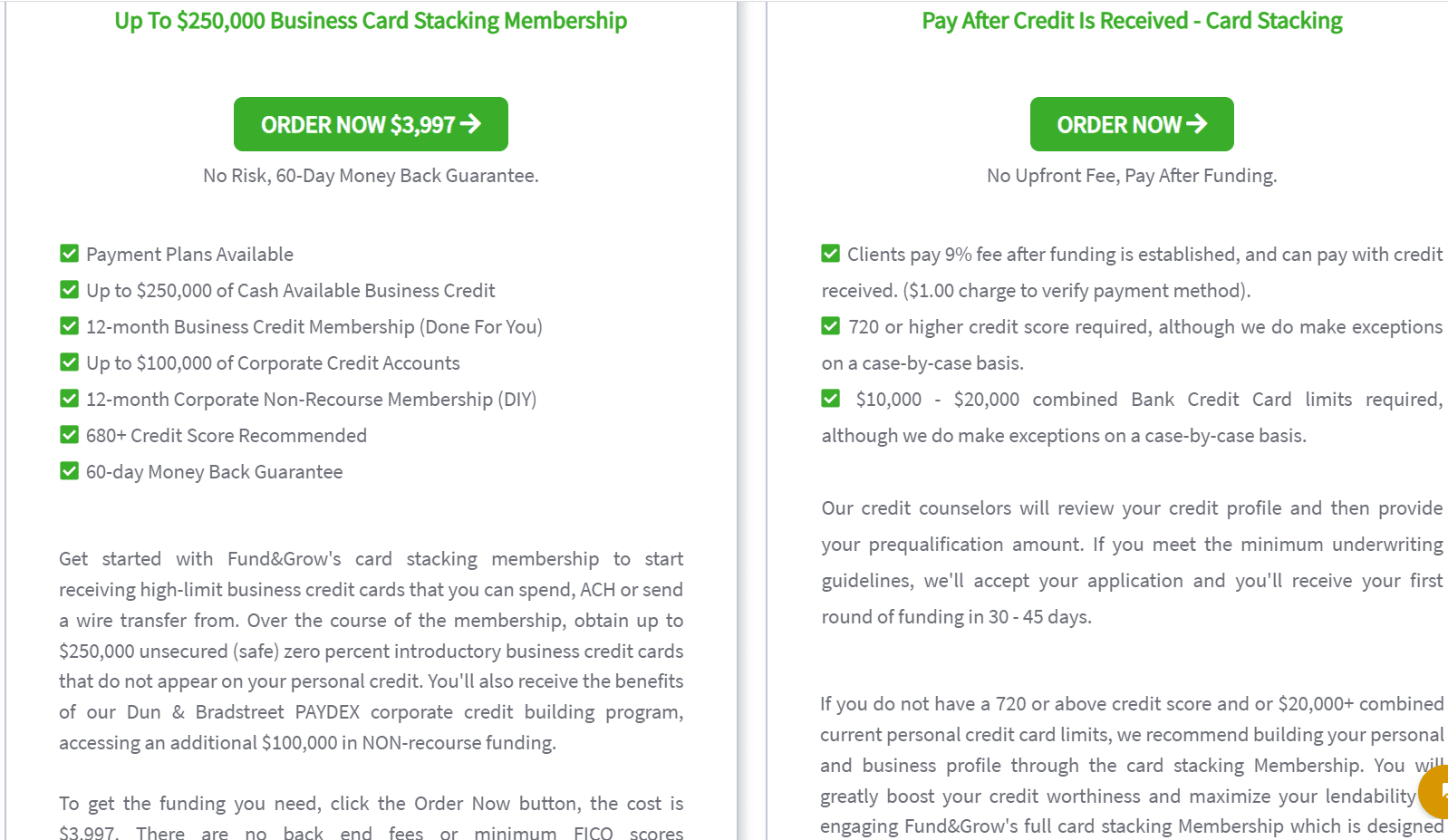

How Much Does Fund and Grow Cost?

There are two plans, and starting with the first one...To get all this exclusive help from Fund and Grow, the cost is $3,997 for the entire 12-month done-for-you program, and get up to $250,000 Business Credit Card Stacking. There is a special price that’s limited and you can get it for $3,497, which is a $500 off special. And if you’d like to start and make payments (by financing), then you can split it into 3 payments of $4,497 total.

When you finance in terms it’s just more, that’s general. When you're on the "order" page you can get into a payment plan of:

- 1 payment of $3,997

- 2 payments of $2,124

- 3 payments of $1,499

There is a No Risk, 60-Day Money Back Guarantee. Also, there are no backend fees or minimum FICO scores requirements. You get a simple cancelation process. If you do not acquire credit through the services, you’re able to cancel your membership and get a full refund (minus 4% processing fee).

There's also this "performance based" option without an upfront fee, and you only pay after funding. Here's more:

- You pay a 9% fee after funding is established, and you can pay it with the credit you receive (there's a $1 charge to verify the payment method).

- A 720 or higher credit score is required, although Fund and Grow does make exceptions on a case-by-case basis

- There's $10,000-$20,000 combined Bank Credit Card limits required, although they do make exceptions on a case-by-case basis.

So what happens is the credit counselors will review your credit profile and thereafter will provide you a prequalification amount. If you meet the minimum underwriting guidelines set, then Fund and Grow will accept your application and you'll then receive your first round of funding in 30-45 days.

What if you don't have 720 credit? Fund and Grow go even as far to let you know that if you don't have 720 or above credit and or $20,000+ combined current personal credit card limits, they recommend building your personal and business profile through the card stacking Membership.

Here’s what you’re getting again overall:

And the bonuses with more in case you forgot and just need a reminder

P.S. If you feel the costs are too high for you and you'd like an alternative option and perhaps to get more milage out of many more funding options I can help you with, click here to see the alternative to business credit cards and credit lines

Who Is Fund and Grow For?

Fund and Grow is for startups as well as non-startups who need access to business credit lines through business credit cards at 0% interest for on average 12-18 months and want more of a done-for-you membership. It’s also for that person who may not 100% be a startup but has time in business and doesn’t want to start a new one.

Here’s more:

- Beginners who don’t have any business credit established and want to get it established and credit reporting to the major business credit bureaus so you can get access to more funding on the backend even without a personal guarantee at some point and be able to leverage that more than always getting loans (PLUS: Fund and Grow also has a loan department to service as well)

- Intermediate and advanced business owners who have enough time in business and or have business credit established but not enough or any business credit cards as well as don’t know how to handle getting approved for higher limits and optimizing your profile to do it.

- Business owners who don’t want to spend YEARS (literally) of making mistakes trying to get access to business credit cards and higher limits, let alone have the credit reporting correctly.

- You want a team to go to work for you and communicate with the bank(s) on your behalf to help you get approved for the maximum amount of funding

- You need expert help and are tired of trying to figure it out for yourself, only to find yourself making mistake after mistake, and then later discovering you don’t have enough to cover your expansion project(s), working capital, inventory, payroll, buying a business, real estate investments, etc. It's convenience you're going for instead of doing it all yourself which you could figure out but it would take energy and time you may not already have - and you get trained people on the Fund and Grow Team who know how to take care of things.

- You want to fully optimize your credit profile without guessing and trying to do it all yourself

- You don’t want to be limited to getting a certain business loan/funding because you don’t have enough funding to use yourself already or because of certain qualifications/requirements the lender/organization has

- You are a real estate investor looking to purchase properties and want to have more cash on hand for your deals instead of doing it other ways where you don’t have maximum leverage

- People who want a PROVEN Step-by-step process to get you maximum funding

Who It’s Not For:

- You Can't Invest in yourself and that means by putting some skin in the game to put the investment down so you can finally advance

- You have enough approvals

- You already struggling to manage your finances and financial responsibility and accountability precisely more so with credit cards

- You are not responsible about paying your credit cards off in the introductory period and then you see a huge spike in your APR and can't make payments then

- All you're focused on is using the money as bad debt and not good debt, although there's a time and place, just make sure you're not overleveraging yourself.

- You can't be financially ready to make monthly payments

- You want to do it on your own and have a proven system/way too

- You don't need a membership and would rather do each part individually and know how (or would like my help to do that)

- You don't have the higher credit to do the second option in the 9% fee plan although you can get assistance in that.

- Tire Kickers

- Lazy People

Pros And Cons:

Pros:

- 12 Month Done-For-YOU Business Credit Membership that is worth EVERYTHING and a bag of chips so you don’t have to worry about getting approved for maximum funding so then you can liquidate even the cash out of these cards and use them for ANY investment you choose which means you will have freedom of range to use your cash to the best of its ability.

- You get the Dun and Bradstreet PAYDEX corporate credit building program where you can get access to an additional $100,000 in NON-recourse funding.

- PROVEN Results you can rely on so you can smoothly get into getting high enough limits to help you do things sooner rather than later which means you’ll get farther ahead in your journey in less time

- Credit Coaching so you don’t have to feel alone trying to do this yourself which means you’ll always know what to do, what to improve on, and where to go next

- The team handles the bank communication and more like helps access your credit reports to better understand how to improve your chances of getting funding

Cons:

- They are not "The" go-to for trade credit and all vendor credit but are helpful in that sense all will help you with your business credit.

- While it is Startup friendly, I would say there are alternatives to it that would be a better fit that encompasses like 401k/IRA financing, alternative SBA Financing and more.

- It could be the high costs for you to afford

Alternatives

There are definitely close alternatives to Fund and Grow and although Fund and Grow are one to go with especially if you’re focused on getting business credit cards at 0% interest, there’s this one too:

Credit Suite is my personal favorite because you can also get access to 0% interest for 6-18 months through their “Credit Line Hybrid”, but they also spend a great amount of time helping you improve your “Funability” which are things like Revenue, time in business, credit, and more as well as work on also establishing Trade Credit with “Vendor Credit” with places like Uline, Grainger, Quill, etc. as well as with Fleet Credit, Retail Credit and much more with a robust system they've put together for you.

If you’d like to learn more about Credit Suite, I made a personal review of them you can click here to see. By the way, I also made a review of Credit Suite vs Fund and Grow you can see by clicking here:

GoKapital is Awesome for helping you with multiple services from startups to non-startups but they have this personal/startup loan where you can get a combination of installment loans, Line of Credit (LOC) or personal and or business credit cards and is one of my favorites for sure.

National Corporate Credit is very similar to Fund and Grow and somewhat Credit Suite but they like to focus a lot more on the startup funding side of the equation and work to optimize different solutions for your startup (this encompasses the 0% interest credit cards as well).

Bitty Advance is great for “Non-startups” looking for advances/loans for business through a revenue-based lender without collateral and low credit is acceptable. It’s not a business credit card stacking program rather you can get right into an application and is based on the cash flow and all revenue performance of your business bank statements (and there’s even an alternative to use personal bank statements).

What I Liked Most About Fund And Grow

I really do LOVE how Fund and Grow work with your personal credit profile closely to understand what is happening and what you may need to improve, and that could take the form of credit repair first before which is fine and understandable.

Aside from that, you get to optimize your profile before the team goes to the bank and communicates and negotiates how much funding to get you in 0% interest business credit cards for usually 12-18 months on average.

So it’s done-for-you business credit card and credit line limit getting which you can’t always get with other programs.

What I Liked The Least

There really isn’t something I “Liked Least” but if I had to entertain it, the ONE thing is that the costs for the membership but it really isn't a bad thing, it's not all about costs but the value you get so that’s not a downside at all, everyone has their focus.

You can get other services outside of business credit cards with me since I’m an expert business loan broker who can help guide you with other services as well and I have quite a bit of targeted funding sources.

Final Thoughts (And What To Do)...

What part about Fund and Grow did you enjoy learning most about today? Was there something you thought you liked least?

With the Prime rates increasing, banks restricting giving out “Term Loans” and pulling back on true business lines of credit as well as Private revenue-based lenders making it a bit harder to get approved for loans, you have business credit cards to fall back on.

With business credit cards at 0% interest for 6-18 months or on average 12-18 months, you can cover your butt with access to funds on the backend you can run up time and time again without having to worry about affecting your personal credit profile and being held liable on your personal side, and this…

Cards can eventually be liquidated and turned into cash to use for different investments through a certain process. When you separate your personal and business credit, you became more lendable and trustworthy in the eyes of a bank loan lender or private loan lender/investor.

To get business credit lines and installment loans and more, you can become more fundable for even an SBA 7a loan lender up to $5,000,000 and the approval odds become higher with a greater score and FICO SBSS score more precisely.

You have two roads as I see it…You can continue going down the wrong path by “trying” to figure it out for yourself or perhaps with someone you are already with (getting overpromised and undelivered and nothing happens or fast enough) or you can finally take the BEST step for yourself and your business and have the funds at your disposal to use whenever without scrambling last second and not getting what you need…

Which one will it be? If you’re ready to get started, click here to see the Fund and Grow Masterclass OR you can see my favorite 0% credit card stacking program along with other ways of getting funding with Credit Suite here OR if you want to see how to get an advance/loan in terms of a "Lump sum" (with at least $3k in monthly revenue in the last 90 days) and or a "business line of credit" that are not business credit cards (and you do $500k+ in annual gross revenue for this market with stronger credit), you can click the button below to learn more about my #1 recommended funding program for non-startups.