How would you like to have an “Instantly” approved small business loan from $2,000-$25,000 on the same or next day...Or how about up to $2,000,000+ Incredibly fast with our without collateral?

Welcome to this Bitty Advance Review where I “Michael Granados” a small business owner like yourself (owner of Viral Funding Solutions too) who has many years of getting funding and helping Many business owners of all backgrounds and industries as an expert business loan broker/agent get funded, will be pulling back the curtains to show you the HARD truths, the pros and cons, alternatives and so much more so YOU can finally get out of your rut and help your business grow to the next level, but first...

You’re a hard-working person who deserves to keep pushing forward - to keep moving your business to it’s Ultimate growth and as a small business owner myself I know the ALL too daunting feeling of your face going pale…

The cry of agony when you can’t reach into your savings account for funding, reaching out your friends and family without rolling your eyes, and trying to use the Banks as your last resort only to find out you get a HUGE “Denied” stamp on your forward!

To make matters worse...You end up with an avalanche of mental frustrations that just crush you physically in body and in spirt (especially all the ENDLESS Organizations trying to email you over and over to submit bank statements and an application to taking an offer you are Unsure about (don't go through this, or any longer, it's a TRAP!)...

PLUS: They are usually not good and right for you, and it's overwhelming thus leading into an even deeper trap) and to Ultimately closing your doors because of finances and the frustration of keeping up. Fortunately, there’s a solution - Bitty Advance. With Bitty you’ll be able to finally get fast same day funding, get funding with even bad credit, and go through a simple approval process.

So to answer the "is bitty advance legit" question before moving forward, yes it is. there is no bitty advance scam, okay?

NOTE 1: This post is Most up To Date And Will Always be Kept up to date and I believe will be the ONLY post you'll need to help you navigate and get the BEST for You and Your Needs. Which by the way, you'll learn from MANY providers and Not just Bitty, that's why this post is great.

NOTE 2: This post is Literally Unlike anything else out there and you will have a chance to even get started with your service below - Please bookmark this post if need be as it can be a lot, but you need to see it and what others don't share with you but I will get specific, please read it thoroughly.

Alright, let’s get into the specifics.

What Is Bitty Advance?

Bitty Advance is a leader in the Merchant Cash Advance (MCA) industry who’s purpose is to provide capital to thousands of entrepreneurs in ALL 50 states. They fund small business owners between $2,000-$25,000 and even up to $35,000 (same-day possible) as well as now up to like $100k+ (for more premium clients) and continuously if you or someone else wants more of it.

In case you didn’t know what an MCA is, it’s an agreement to exchange your future business revenue for an upfront amount of cash advance to you immediately. They are not "technically" a "loan" or a traditional business loan amortized like the banks do, so while many people may think the words "bitty advance business loans", it's an advance, not a loan (the majority of funding online are advances).

MCA’s have been successfully used by nearly every type of small business, including:

- Restaurants

- Doctors

- Trucking

- Construction

- Consultants

- Health Care

- Child Care

- And many others!

P.S. If you need more than $25k and or even $35k you generally want to be doing north of at least $25k+ per month and or $35k+ per month "Initially" to get between 75%-200% of your monthly revenue, and I'll show you an alternative where you can get up to $2,000,000 Incredibly Fast with an exclusive platform and BEST Lender partnerships anywhere (literally) I help broker/agent for IF you meet the qualifications of $15k+ PER Month within the last 3 months instead of $5k per month, - I'll reveal it in the "need more than $25k" section below, but if you'd like to see it and have that revenue you can skip to it by clicking here (otherwise continue reading about Bitty First below).

Going Inside Bitty Advance

Did you know there's Bitty advance partners that can fund you in a more secure way?

Cool thing about Bitty Adance llc is they’ve partnered with one of the Industry Leading alternative small business capital companies.

This is a small business funding program where you can get up to $25k TODAY (no joke) in Revenue-Based Funding - which is not to get the term confused with a Merchant Cash Advance...

Revenue-Based Funding is more traditional, it's not based off your future credit and debit card sales, you get a fixed payment plan unlike MCA's, and is WAY Less expensive - So in all it's A LOT better! It's a Hybrid of an advance if you will.

Plus, you can get instant approval and same day funding cash advance which is Unheard of in the industry, how?

But in short, this program is a branch of More Funding Services where you can get up to $2,000,000 in funding. So you get options:

- Up to $2,000,000

- Up to $25k

- Up To $100k

- Up To $5k

- And More!

So the bitty advance partnership is VERY real and there's nothing else out there like it. Now here are the qualifications...

Bitty Advance Qualifications:

Here are the Bitty Advance requirements:

- Be making at least $5,000+ PER month (if you're doing $3k on your lowest month in the last 90 days, see the "self employed" option below and IF you're a startup with pre-revenue, see the alternative section for the "first startup friendly option"

- 6+ months in business (If you have 4+ months time in business with $5k+ in monthly revenue and on your lowest month in the last 90 days, there's another option below you can check out - and if you have 3+ months with at least $3k+ in the last 90 days but not $5k+, there's an option below for that too - As a startup you can check out the alternative section below with the first "startup friendly" option)

- 500+ FICO Experian credit score but a lot of the times 550+ credit score is beset especially with business owners having insufficient funds, negative days in excessive, etc. (even 450+ can work under the right circumstances)

- You need a business checking account NOT A personal account you are using for business

- Business Entity LLC or Corp or sole Proprietor

- Minimal NSFs/Negative Days - No more than 5 NSF or negative days ANY of the last 3 months

- All industries welcomed

- Online banks that is most acceptable is Square, all else like Money Lion, Found and others won't work - Get a traditional bank.

- Current loan consideration PART 1: If you have a current capital advance, the amount still owed will be taken into consideration and cause a reduction in the approval ammount. More funds ("2nd Positions") MAY be avaialble.

- P.S. IF you need a third position or even fourth then there's a bigger tier service down below you have to see if you qualify for.

- P.P.S. If you think by getting more advances it should decrease your rate and increase your terms as well as get you more funding then your current positions (balance taken into consideration), you are HUGELY mistaken. Usually and more specifically taking your remaining balance as well as your profile into consideration, your rates could be higher and terms could be lower with more positions.

- Current Loan(s) Consideration PART 2: The majority of Lenders will NOT lend you another advance/MCA within 30-45 days, so make sure it’s been past 45 days to then take another position

Your approval amount is up to 75% of your monthly revenue, for example:

You make $10,000 Monthly Revenue = $7,500 Advanced Offer. These are 4-6 month terms with automatic daily payments - Which daily is better than monthly because it's easier to go into default with monthly payments and you get a smaller percentage taken out of your revenue - much better than other options...

You know how much is being taken out daily with any fluctuations. PLUS many people can't qualify for a monthly/weekly payment with longer-terms to even start so it wouldn't make sense.

NEW UPDATES 2023! Please Read This Next Part Carefully...

P.S. We have updated our app sequence (2/17/2023) where Bitty is NOT the only provider you can get funding IF you're doing less than $15k on your lowest month but above $5k is where you sit and the approval amounts are now between 75%-200% your monthly revenue (usually your lowest month in the last 3 months but we look at average too and see where you are there)...

And later below when you get started with your app sequence we'll give you a chance to see a different provider then Bitty with the exclusive BB partnership I have..

And we'll give you a chance to get between 75%-200% (but more so 75%-150% or 120% with lower sales, balances, etc) of your lowest monthly revenue in the last 3 months and instead of "linking your bank" like how bitty works, we'll ask for you to upload at least 3 months of business bank statements into our safe and secure app process for review and from there I/we will get you the best provider that may be Bitty or not...

There's a Special and Exclusive "App Sequence" you'll go through with D.A.C. and BB where we do more of an in-house look where I/we already have direct lender partnerships But it's better to do an in-house look to get you the best offer (without hurting your credit, we are very protective of you)...

So you can skip to that part now by clicking here to see the BEST and most up to date micor and macro funding provider OR...

Keep reading the Bitty part to this though and then after I'll show you where to apply to get started.

NEW Addition Too: As of June 2023, one of our new providers is doing Same Day Funding up to $10k! Their approvals are going to be between 25%-75% monthly revenue for those doing at least $3k per month on their lowest month and at most around $15k or just slightly under like $14k but not $15k...

If you'd like to see the same-day instant funding and you meet the minimum revenue qualifications, click here to learn more about it.

Bitty Advance Rates...

The rates (not Interest rate based since these are advances not bank loans), are between 1.19-1.69, or in other words, the cost of funds is between 19%-69% of the amount we will fund you. You can call it interest rate but it's rather a factor rate, and without offering up collateral, and you have a risky business financially, you have to understand why the rates are high, right?

To get a bitty advance approval you do have to make sure you meet the requirements and do ALL of these steps I will mention just below in a second, okay?

But first, if you DON'T meet the Bitty Advance qualifications/requirements I just mentioned above, you can jump to the alternative section by clicking here (otherwise just keep reading the application steps for bitty if you DO meet the qualifications coming up below in a second).

Does Bitty Advance Report To Credit Bureaus?

No, because they are revenue advances not loans. The only time they report is IF you default and need to to go to collections. This is actually a GREAT thing and here's why...

Just think about it for a second - If you were to get a Personal term loan/installment loan, personal lines of credit, or personal credit cards, would you want to take on a Large amount of financing only to have it showing on your personal credit as a Liability now...

And that of course will bring up your utilization, Debt-to-income increase, it can drop your score after a hard credit check for hard offers...

But what happens when you can't make the repayments?

You are putting your Family, your personal assets and more you've probablly worked hard for on the line. It's each to their own I get that (and if it's your only option to do this), but then comes filing for bankruptcy in a worse case scenario.

So these "advances" and what you'll keep seeing below with needing over $25k and over $35k, the lender won't report timely payments to the credit bureaus because these are "advances" against your future receiveables, not ammorotized like a traditional business loan and are not traditional business loans.

Bitty Advance Application (Step-by-Step Process)

The bitty cash advance application steps are pretty simple and before I show you the app.bitty advance.com, here’s what you’ll go through with the bitty advance pre approval and more:

- STEP 1: Fill out the small business funding details

- STEP 2: Pre-Approval Page. You’ll get your loaned amount and you can either accept or deny it.

- STEP 3: Add Your Business Information

- STEP 4: Business Revenue Verification

- STEP 5: Update your offer

- STEP 6: Fill out owner information

- STEP 7: Upload your drivers license

- STEP 8: Upload a voided check

- STEP 9: Done. Your loan is ready to transfer into your bank account.

For a visual/image representation of the application process, click here to see. Note...

We have updated the app sequence (2/17/2023) where you won't always go directly with my direct lender Bitty but to one of our other organizations (that is very legit and I work with them everyday) where like I said earlier, we will ask you to submit the following:

- At least 3 months of business bank statements

- A copy of your drivers license

- And A Voided Check

Thereafter, I/we will go to work to find you the better provider which could be Bitty or elsewhere (you'll get the best this way without affecting your credit).

Go through the bitty advance apply and it's partnership here:

NOTE 1: On the following page (when you click the button above), you can go to the "business capital" navigation tab to get started and go through the app sequence.

and in case you need my bitty advance agent id, it is 102537113

NOTE 2: Please submit the Application ONLY if You are Serious and WILL Show up when I'm there to help and reach out along the way to follow up with you and IF I need feedback. I will guide you, and let's make this a frictionless and as smooth as possible.

1099 Self-Employed, Contractor/Gig Worker Service...

What if your a 1099 contractor/gig worker and need funding?

Good news, on May 1st 2022, a NEW service was launched where you can FINALLY apply for funding and even without:

- A business checking account (just use your personal bank account)...

- Without a FICO credit score check (No credit check whatsoever!)...

If you want to check out how this funding program works and how to get up to $5,000 fast, Click here to see my in-depth review of the program

Bitty Advance Forgiveness Loan?

There is no "Forgiveness" for not paying back your advance which is Your responsibility and it's part of the accountability you need to have and own for not being able to pay what you can back...

That's why You have to understand how to use your funds and what ROI potential it can bring so you're not biting off more than what you can chew. However...

There may be stress and hardship you face and you can get in contact with the lender and or myself and maybe we can try to extend the term or somehow lower your payment temporarily, but don't depend on that happening, make sure you make your payments on time if not earlier.

Bitty Advance Customer Service

How's the Bitty Advance customer support side of things?

Bitty Advance has a great customer support team from all parts of the US (Not just Florida) who are dedicated to help answer any questions, frustrations you may have. I've had people at times ask me "Why is there a person with an accent on the phone" as if it to say "Is this legit"...

And yes it is legit. I know sometimes we worry about who's on the other line and making sure they are not "scammers" but I'm here with 100% confidence and certainty telling you this is 110% legitimate and trustworthy service.

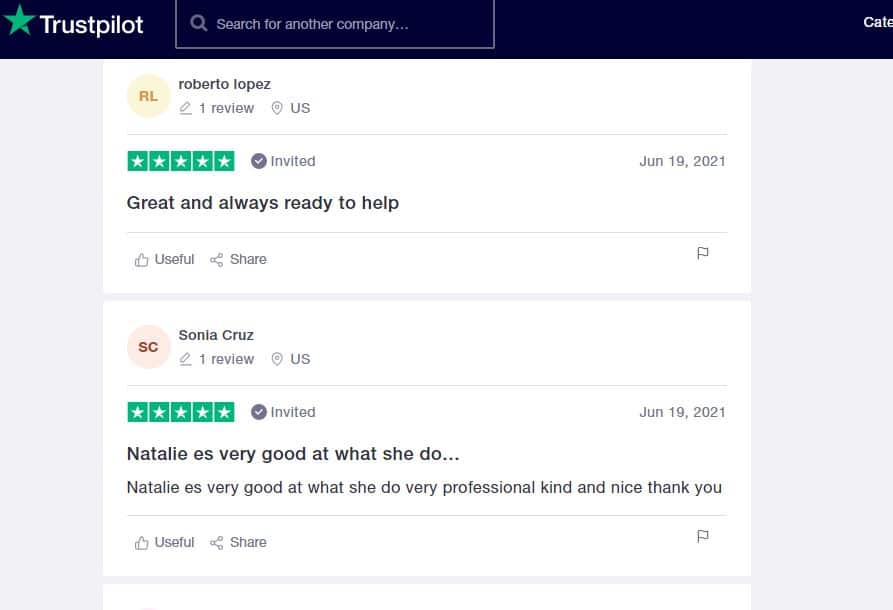

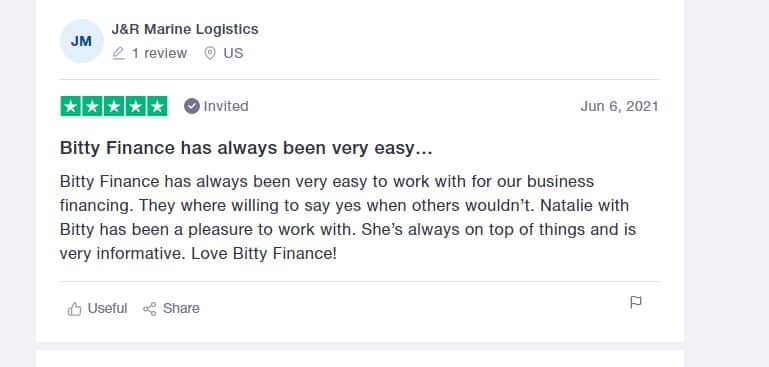

Bitty Advance Reviews

Here are some bitty loan reviews reviews on Trustpilot:

Aside from thos great bitty advance loan reviews, here's on the BBB...

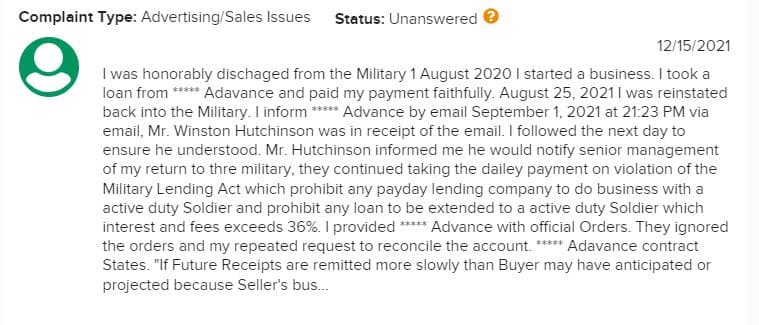

Bitty Advance BBB

On the Bitty advance bbb website it says it's currently not bbb accredited (which isn't necessarily a bad thing), and there is currently one complaint, BUT keep in mind that this complaint (and if there were any others) are usually misleading and it's a matter of not fully understanding the service or just trying to bash the company.

So like I said earlier, it's just not fully understanding the contract and what they were supposed to be doing. So outside of the bbb and bitty finance reviews, here's this next part...

Bitty Advance Lawsuit?

There is NO Lawsuit against Bitty Advance, so if you're searching for one thinking there is, well there is not. I just wanted to bring this up because I know people are trying to find out if there is something to blame or find bad in Bitty, but no. You can rest easy knowing you won't run into any problems.

Also, the way there is a Lawsuit IF YOU have a default with a judgement in place...This is where you defaulted on making one or multiple payments and as a result, you defaulted. And a default judgement is where there you have been sued and a court order from the creditor and or debt collector/lender so they can get there money back and in various ways - personally and or in business.

So make sure You make your payments - That goes for any advance/business loan out there. You are liable. If you endure hardships in making the payment(s), then we might have a relief program for you but get a hold of me/us as soon as possible.

Related: What happens if you were to default on a cash advance/term loan

Would you Like to get a personalized and customized email response on your Best Funding option(s) very thoroughly broken down step-by-step? Click here to fill out a less than 30 second questionnaire to get your option(s).

How Much Does Bitty Advance Cost?

It’s completely Free to start and finish your application. The only cost will be your time and energy so I HIGHLY advise you know the requirements for getting accepted into the program so you’re not wasting your time and find out you get upset if you don’t get approved.

If you're ready to get started with bitty finance and the partnership I have, please see this first...

NOTE 1: After clicking the button below you'll want to click on the "business capital" navigation tab at the top of the page and start there with your app sequence.

and in case you need my bitty advance agent id, it is 102537113

NOTE 2: ONLY Apply IF you are serious And want a TRUE Expert to help you along the way and reach out to you for support and IF I need feedback from you. This isn't just ANY application where you get a robotic response from a rep or someone else who doesn't care about you, I will reach out some point along the way most likely. You are getting the best.

So click the button below to get started with your application...

To view the requirements, look just below to see "who" this service is for...

Who Is Bitty Advance For?

Bitty advance is made for small business owners who want and need small business capital from $2,000-$25,000 same day or next day funding to grow, expand, make payroll, get more inventory and for many more reasons. Here’s more:

- Business Owners with at least 6+ months in business

- You’re making $5,000+ per month in revenue

- You have a business checking account

- 550+ credit score

- ALL industries included

Who’s it not for?

- People who don’t meet ALL the requirements up above in the “who’s it for section” (no exceptions!)

- People wanting more than $25k or $35k who have the qualifications for it.

Pros And Cons

Pros:

- Super fast same day funding up to $35k and even a derivative of that for up to $25k so you can put your money to use right away and get out of a tight pinch, grow, and expand which means you'll grow your business much faster and keep everyone happy.

- Minimum qualifications of a bad credit score, minimum monthly revenue of $5,000+, all industries included and many more which means you'll have a higher chance of getting approved and have a safe secured loan at the same time.

- Straight forward application process so you don't have to worry about going through complicated rates and pre-payment applications like many other places which means you'll get through it faster and feel like you didn't burn a sweat!

- Reputable and a leader in the MCA industry so you can have 100% confidence and certainty that you'll be well taken care of and be able to secure a loan that will pay off in the end.

Cons:

- I wouldn't really say there were any cons and I'm not saying this to be biased but maybe I'd say it's not best for sole proprietors. Even then that's not a con to be honest with you.

- Limited to only $35k or $25k with their partnership with another program.

Alternatives

There are NO close alternatives to the bitty merchant cash advance (at least not yet) so I can’t say there are other and even better alternatives to turn to for business funding up to $25k who ALSO offers the smallest requirements to get approved for. However, there are other one's like:

- Up To $2,000,000

- GoKapital (Startup friendly)

- Credit Line Hybrid (Startup Friendly)

- Credit Suite (startup friendly)

- Fundera

- Lendio

- Fundwise Capital

- Rapid Finance

- Lendza

- Everest

- Fountainhead

- Business Capital With National

- Fund and Grow

- ERC Pros (Payroll Tax Credit)

- Fundzio

Fundzio and bitty advance are owned by the same person, it's just that Bitty offers smaller advances of $2,500 to $35,000 alone with a turnaround as fast as soon as the same business day and I believe are more reliable and I get A LOT done with them and people are very pleased.

Fundwise has higher requirements you may not qualify for. If you're a complete startup with pre-revenue, then you can check out GoKapital here and or Credit Suite Here. There's also the credit line hybrid

So I recommend Bitty Advance with their partnership(s) for sure. Start your bitty advance 2 Application here:

NOTE 1: Once you click the button above, on the following Page you'll see the partnership with Bitty Advance so there will be a different webpage name which is Legit and Trustworthy, from there you'll go through entering simple information and then go through a quick "questionnaire" and if you meet the qualifications for Bitty, then you'll see the "Bitty advance" page.

NOTE 2: ONLY Start AND Submit the application up above IF you're serious and you want an expert in myself to help and not some robotic rep or answering machine. I will likely reach out at some step in the process just to touch basis and see how you're doing, and IF I ask for feedback you won't just dissapear and waste my energy and time as well as someone else's like the lender and underwriters.

Related: Get guided support from Viral Funding Solutions

The "Up to $2,000,000" option you'll learn about next on how to get a "Hybrid" advance and term loan, but there's also the "Business capital with National" option where they can do a variety of options like asset based financing, and SBA 7a loans and a little more services...

but I would start with the "up to $2,000,000" below first...

Need More Than $25,000-$35,000 And OR Want To See How To Qualify For More? (NEW Providers That Are NOT Just Bitty Advance)

In the case that you're wanting more than what bitty has and $25k or more than up to $35k as well as IF you qualify for it, I recommend checking out the "bigger brother" of Bitty Advance and another service where we can help out "mirco revenue-generating businesses" that are doing $5k+ and macro doing $15k+ in monthly revenue which is the This One Right Here (BUT Read Below first to see if you Qualify!.

With this program you can get an approval within a day, funds deposited within 1-2 days as much as week depending on your file/portfolio and you can get 75%-2x (75%-200%) your average monthly revenue/Lowest Monthly Revenue in the last 90 days IF you're doing $5k+ within EACH of the last 3 months (it used to be $15k+ per month requirements but we've since then updated with new providers)...

And even if you are and want less than $25k or up to $25k, you should still consider applying through the "manual process" up to $2,000,000 service. But before I show you how we underwrite later below (the BEST) just know that to get past $25k or $35k, you need to be doing around $25k (sometimes $20k per month) or so on your lowest month to get between 75%-200% but there's more to it then just that (PLUS: You need to begin somewhere and the build the relationship with the lender).

Qualifications For This "Up To $2,000,000" Revenue-Based Program:

- You're making $5,000+ in monthly sales within EACH of the last 3 months

- 450+ FICO Credit Score

- 4+ Months in Business

- U.S. and Canada Available! (Find the "Canada Funding" section below to see more specific details. What you'll keep reading below is for U.S. Again, the Canada section is later below to refer to or you can click here to see for Canada as a shortcut)

- You must have an opened business checking account (Must be in name of your business, not a personal account used for business - If you are using a personal account for business and have at least $3k+ in monthly revenue, then go to the top under the "self-employed" section)

- You are not transferring funds from multiple banking accounts as well as not from personal to business checking as that doesn't count as "organic deposits" or "true deposits", thus it's not actual revenue.

- LLC or Corp or Sole Proprietor

- Minimal NSFs/Negative Days - No more than 5 NSF OR negative days in any of the last 3 months.

- Only online bank fundable is Square, all else like Money Lion, Found and others will not work since they can't process the ACH part and even the decision logic bank verifcation part - So get a traditional bank

- Current Loan Consideration PART 1: If you have a current capital advance, the amount still owed will be taken into consideration and cause a reduction in your approval amount. More funds (2nd-4th positions) May be available. If your loan is an EIDL loan, it will NOT affect you and causes a reduction, they are separate from these advances.

- P.S. If you have a first position only or more, we will take the balance into consideration to see what if anything we can give you BUT don't be surpised when the rates are higher and terms are lower as well as much you get be lower than your other positions (what you initially received). ..

- Usually the rates increase with multiple positions.

- Example: You have one position with $30k and remaining balance is not paid over 50% and not closer to 100%, then potentially it could be reduced to $10k-$20k for your second position and so forth.

- Usually the rates increase with multiple positions.

- P.S. If you have a first position only or more, we will take the balance into consideration to see what if anything we can give you BUT don't be surpised when the rates are higher and terms are lower as well as much you get be lower than your other positions (what you initially received). ..

- Current Loan Consideration PART 2: The majority of lenders (usually ALL) will NOT give/lend to you another advance/funding position within 30-45 days, so please make sure you wait past 45 days to get funding again - I can't tell you how many times people apply and get declined because they just took funding out the other day, last week, etc, and it's not a good look - Even then people take the Wrong funding from the wrong provider so be careful of others you are applying to as you will likely not get the best.

- Not have a default with another advance/loan company. Regardless of how long ago. You usually don't get any more funding in this industry with a default - there's like 1-2 lenders who "may" help you but you'll start with a lot less, if you get any at all. There can also be a default with a judgement in place which doesn't make it any better. And when you default on a "lump sum", no lender will lend lines of credit.

- Background checks - If your background report comes back with a criminal record or past financial issues and past UCC Filings too, then it can be an automatic decline.

- NO MCA Defaults (again)

- Not used for real estate investments like fix and flips, rentals, etc - passive investments - use the personal/business/startup funding for that and the credit line hybrid that you can see later below and or traditional real estate financing private lenders with my real estate specific form.

Also NOT have issue with:

- Financial Fraud

- Past default and past judgment in place

- Submitted altered bank statements to another lender

When something like the above issues happens, you end up on what's called the "DataMerch" which is a system lenders use to determine your future eligibility of getting a loan. Once you have one or more of these, you can NEVER get funding in the industry again (so be careful with what you wish for).

Are you a startup business with Pre-Revenue And Looking For Startup "Lump Sum" Funding and perhaps a combination with business credit cards and more? Click here to learn more how to get a personal/startup loan and more

Related: Credit Line Hybrid With 0% Interest Business Credit Cards (Startup and Non-Startup Friendly)

So the Approval Amount for just about every industry is approximately 75%-2x your monthly revenue, Ex: $50,000 monthly revenue = $50,000-$100,000 advance offer.

The amount you "can" get will vary on factors like:

- Revenue - Cash flow, amount of deposits, remaining bank balance, consistency, etc.

- Fico

- Negative days/Non-sufficient funds and more.

EXCLUSIVE BONUS: There's an Exclusive partnership program (you can't get anywhere else, literally) where you can pay off your funding much faster by getting the opportunity to get extra cash by sharing our service with your network of relationships, which earn you 2% of ALL fundings - 0r 1% of ERC Credit referrals.

So you can pay off your funding much faster by reffering others who get funding and at a much cheaper price!

NOTE 1: When you click the "green" button above, you'll want to go to the "Business Capital" Navigation tab and get started there and start your app which I'm in partnership with. If you're on mobile, you can go to the "hamburger lines" at the top right of your screen.

NOTE 2: ONLY Start your application AND Submit it FULLY if you are Serious and want the VERY Best for your current situation and not having to worry about faulty lenders and other organizations/broker/agents fooling with you and wasting your energy and time. Your information is safe and secure and we will only show you the best lender for what you need and the BEST of the REST for your situation.

You will get the BEST with me and the right lender and that goes for communication..I will be following up with you just to let you know where you are in the proces (NOT to heckle you!), and IF I ask for feedback and you go mute especially at the point of an offer if any, I don't want to work with you, it's as simple as that...We're not here to create and increase friction, just make it as smoothe as possible...

And that you're not wasting anybody's energy and time, including the lenders and underwriters. But again, if you want the best, you wil get the BEST, just be serious. There's no other program like this.

What about interest rates?

We don't have any (and I'll speak on this later down below), we calculate on "Total Payback" which is much easier and not complicated like rates are, PLUS, we're very inexpensive compared to everywhere else.

Your Repayment Amount is 1.19-1.49x your advanced amount. Ex: You receive $60,000 and you pay back between $72,000-$89,500. I know what you're thinking...

Why Is Your Total Payback Medium To High?

These are "Non-Collateralized" advances and the lender assumes 100% of the risk in the case that you default they don't collect property. And instead of thinking about the "costs" all by itself, think this...

The Benefit Of Taking YOUR Funds NEEDS To Exceed YOUR Repayment! IF You are going to cry and complain that your interest rates or in this case total payback (it's not ammorortize liked a traditional business loan so not based on interst rates), because it will ONLY hurt your cash-flow (or you're already cash-flow negative), then it DOES NOT Make sense and YOU will NEVER justify it..

You should use this money for growth and expansion to double, triple, quadruple YOUR ROI short and or long-term...Really plan it out!

Even if it's not going to increase your revenue, know where YOU are positioned with cash-flow and if you'll be and stay positive. This also addresses my next point below on the "type of payment structure" in terms of if it is monthly, weekly, daily, etc...

So PLEASE keep an open mind - It's NOT all about the type of payment due dates, rather trying to get a longer-term intially IF you can (and if not GROW into it)...

And making sure your benefit Exceeds your repayment.

These are 4-24 Month Terms with Automatic Daily/Weekly MICRO Payments...

Listen, Daily and Weekly payments can be FAR greater then monthly payments because they reduce your risk of going into default and monthly payments cause more stress having to worry about meeting those monthly deadlines as well as taking on added interest that you have to pay (becomes too expensive). And if you get a default this will happen...

You will NEVER be able to get funding online here or anywhere else ever again. It gets reported. You can ALWAYS get a chance of moving from daily to weekly payments IF you didn't start there...when you make your payment on time, you pay off your advance earlier and are in overall good standing with the lender(s).

But that's what you'll see ALL across the industry, and it's not a matter of "feelings" rather the logic in the math and IF you meet the qualifications and criteria to get a monthly payback and longer term...

But expect higher interest rates if not more than an MCA at about 25% to 50%. I'll show you below what it takes to get a monthly repayment but it's VERY hard to for a "Lump sum" unless it's the SBA 7a Express/Standard loan, Revolving business line of credit, equipment financing/leasing/leasing to own or like a personal/startup loan.

PLUS: If you're "against" daily (or even weekly) payments, it shows two things:

- You don't have a well structured and organized business that can be profitable or stay stable. You're fighting every day with insufficient revenue - Ex: You make $100 one day, and then $500 another, and then like $0 after that and so on.

- Your monthly payments are very in-consistent.

Also, as opposed to thinking about "how much of a rate or interest" you'll have , think about the "BENEFIT" of what getting the money and using it for will be, for ex:

If you were a restaurant wanting to expand and you want to create a New patio to hold more customers, and you believe that will double, triple or quadruple your profits, do you think the total payback would really even matter at this point?

So it comes down to your Repayment and not so much about the rate or even the term in a lot of cases.

P.S. We have a bi-weekly or monthly term Lender in the network now where you can get from 6 momths to 36 month terms and from $50k to $1,000,000 BUT you MUST be doing $50k+ per month in sales within each of the last 3 months, in business 12 months or longer with the following:

- Personal FICO score above 650 (even a 650 is not enough, 750+ is more like it, but if a 650, your revenue should be large)

- Less than 6 NSF's (Non-sufficent funds) in the last 30 days

- Less than 5 Negative banking days in the Last 30 Days

- Closing costs or orgination are 0-2.5%

- Application fee = None

- Required Collateral = None

- Turnaround time = 1-3 days

(Restriced Industries ONLY for this monthly payment option are Law Firms, Staffing Companies, Real Estate companies of ANY kind, Farms, CBD/Cannabis, Mortgage Insurance/Brokers)

NOTE: If your business is strong enough and on like a premium level this monthly option may work, otherwise the 4-24 months is the one.

Rate Calculations

This is more so for the up to $2,000,000 Capital (not bitty advance), but you just to show you the "technical" side of how these rates are calculated, here it is:

- 1.19 to 1.30 = A Paper Lending/Clients

- Clients with great revenue over $50k monthly, excellent FICO (700+) and been in business 24+ months (2+ years) is what you can expect as a payback rate.

- 1.31 to 1.49 = B-C-D paper Lending/Clients

- B paper is a client with revenue above $20k monthly, good FICO (625+) and been in business 12+ months (1+ years)

- C paper is a client with 525+ FICO credit scores

- D paper is a client with below 525 FICO

The rates you get vary depending on your:

- FICO

- Time in Business

- Other credit issues such as past Bankruptcies (if any) or number of current delinquencies

- Lender partners take into consideration time in business and monthly revenue dips when determining your rate.

- Other issues that may impact the rate you get are number of current funding positions, number of NSF's, number of negative banks days, number of inquiries on credit from other lenders, daily balances, along with a few other factors

So you get to see how your rates for the up to $2,000,000 working capital is calculated, the Bitty advance/partnership program side is a bit different because there are less revenue requirements but you get to see what lenders and underwriters will look at.

Related: MCA same day funding

Terms and Rates Continued...

Now that you know the rates, let me show you how the "Terms" are calculated...

Terms are usually dependent on:

- Business Type

- Revenue

- Credit

Like the rates above, we have an "A-D Paper Lending Client" criteria and here it is...

For A&B Paper:

- Weekly/Daily Repayment

- 12-24 Months is what you get

- You must have $50k+ monthly revenue

- 675 FICO Credit score

- 1+ years in business

For C Paper:

- Weekly/Daily Repayment

- 7-11 Months given

- You must have $25k+ in Monthly Revenue

- 600+ FICO Credit score

- 6+ Months in business

For D Paper:

- Daily Payments ONLY

- 4-6 months given

- You must have $15k+ monthly revenue

- 500+ FICO credit score

- 4+ months in business

So after seeing these terms and rates at the top, would you say you have a better understanding of how part of this underwriting process works and what you can qualify for?

Underwriting Guidelines Continued...

So I want to show you more of what the underwriting guidelines entail but I first want to share with you what Documents you'd usually need to submit before a file is submitted to underwriting (again, if I didn't already say this earlier):

- Application - Have it completed, dated, signed and legible

- Bank Statements - Most of the time we just need your 3 most recent months of bank statements. On occasion 12 months (if you request higher amounts of funding and or industry dependent - Like seasonality's).

- Voided Check - Requires Voided check on ALL business accounts submitted

- Driver's License - We'll need a copy of your driver's license for all owners on the application (if more than one of course).

- Tax Return - We ONLY need your last filed tax return IF the funding you're requesting exceeds $100k but usually with the "A-Paper Lending Clients" it's at least $150k when you have to submit taxes.

- Financials - These re requested on ALL requests exceeding $100k - For "A-Paper Lending Clients" it's usually when you're asking for $150k+. **P&L & Balance Sheet, Tax Returns, AR Report (Accounts Receivable) or it's not an AR Report, then a work in progress report that shows you what you have going on in the future if we're going to give you all this money that shows us you will still be in business and you can afford to pay it back.

Now onto the Underwriting:

So each lender has their own underwriting criteria to meet in order for them to provide you with a "solid offer". This will vary from lender to lender especially from "A-paper Lenders to B-C-D Paper Lenders".

Here are the TOP 4 Underwriting Issues that Result in Automatic Declines:

- You (or another client) has a past default with another advance company - Regardless of how long ago it is. If you default at any point, there is rarely a second chance and you just can't get funding online.

- Your background report comes back with a criminal record or past financial issues. Past UCC filings too.

- Your bank statements show 5 or more negative bank days or over 7 NSFs (Non-Sufficient Funds) during one of the last 3 months

- Your Credit is less than the required minimum. "A paper" would be a 680+ FICO, "B&C Paper" is 550 FICO, and "D Paper" is above 500 FICO.

Underwriting Requirements:

- Your application MUST be completed, signed and dated.

- The applicant (whether it's you or someone else) MUST own 51% of the business to apply. Sometimes will be required to own 75%. If not, then 2nd or 3rd owner MUST be on the application

- Transfers from one account to another, loans, refunds or other deposits not relating to revenue will NOT be counted as part of your monthly revenue.

Funding For B-C-D Paper:

Here is what happens in the final two hours before your funds are wired:

- STEP 1:Once your DocuSign or however you completed your application is completed, it will go through our Junior Underwriter which runs final reports such as background, they collect decision logic bank verification link for review and then once they've done their part, your file gets handed to a Senior Underwriter...

- STEP 2: Senior Underwriter reviews the bank verification, checks ownership, conducts funding call(s) to approve the deal and then after they say this is something that we should move forward on, then it gets moved into the Finance Committee.

- STEP 3: Finance Committee - Upper Management approves wire to be sent.

- STEP 4: Wire or ACH - The majority of Lenders send ACH but the "A Paper Lenders" usually send wires.

Funding For "A Paper":

- Your offer is presented and accepted. Once you accept your offer either an online checkout occurs or you will receive a "DocuSign Agreement".

- No Funding Call. There is no Funding call interview because this is an "A Paper Client".

- You sign the funding agreement either through DocuSign or online check out link.

- No Bank Verification. Bank Verification is also waived in 99% of cases.

Are you interested in getting a very personalized and customized email response on your best funding option(s) thoroughly broken down into qualification, how it works, the numbers, Bonus expert tips and more unlike no other? Click here to fill out a fast and simple questionnaire and get a FREE 6-step pre-approval checklist too!

Early Pay Off Discounts Explained...

Our lenders will NEVER charge a "prepayment penalty" for paying off early, however, pre-payment penalties are very different from earl pay discounts...

So now that you understand that, here are the payoff discounts you can get starting with most of the B and C paper lending clients:

- Paid off month 1: You get a discount of 12% of your unpaid balance (includes principle and cost of funds).

- Paid off month 2: Discount of 10% of the unpaid balance (includes the principle and cost of funds).

- Paid off Month 3: Discount of 8% of the unpaid balance (includes principle and cost of funds).

Prepayment Discounts on A Paper Clients

- A Paper lenders will almost always provide prepayment discounts of a range between 20% to 25% of the total cost of funds.

- Unlike for the B and C paper lenders having an 8% to 12% prepayment discount off the "total amount due" (including your principal and cost of funds), the A Paper lender will take the 20% to 25% off the cost of funds only and not the principle borrowed.

$100k Prepayment Example:

Let's say you're getting $100k in business funding, and you're given a factor rate of 1.38 = $138,000 you're paying back.

(The industry standard is half these numbers however most of the lender partners provide the rates I'll show you below)

- Using the 8% to 12% discount scenario (b and c paper lenders), your prepayment discount would end up being $11,040 to $16,560 (minus your amount already paid in).

- Using the 20% to 25% discount scenario, your prepayment discount would either be 20% or 25% of the $38k cost of funds or $7,600 to $9,500.

Does that make sense? It's a very unique way to get accommodated for paying your advance back sooner rather than later.

Canada Funding Option (Skip this section if you are NOT In Canada)...

Have you been searching for the BEST and RIGHT Canada funding program for you and your business?

Here are the funding amount and terms for Canada-Based Businesses and owners:

- You can get Fast online funding up to $500,000 in Approval Amount

- Rule of thumb is 1-2x your monthly revenue

- Ex: You do $50,000 in monthly revenue which equals $50,000-$100,000 advance. Of course, it can also be higher or lower depending on your businesses situation

- Repayment amount = 1.27x-1.49x your advanced amount (depending on your credit score)

- Ex: You receive $60,000 and you pay back between $76,200-$89,400

- You get 3-12 month terms

- It's 3-6 month terms for smaller funding (if $10k+ per month in revenue)

- 6-12 month terms for larger funding (if $15k+ per month in revenue

- You get Automatic Payments with most being daily payments (Monday-Friday) not on holidays. Some are weekly payments. NO Monthly payment options are avaialble with ANY funders.

- Soft offers in 1-2 hours or so

- Merchants qualify for renewal when balance reaches 50%

Minimum Requirements:

- You MUST have a business checking account - Must be in the name of your business, NOT a personal account you are using for business

- Have online banking setup

- Have a minimum of 5+ revenue deposits PER month

- Have 6+ months time in business

- $10,000+ in monthly sales required or $15k+ for larger funding

- Owner credit score of 550+ FICO or 500 for lower funding amount if you're doing $10k+ per month but not $15k+

- Minumum 2+ employees

- Current loan consideration is this: If you have a current capital advance, the amount you still owe will be taken into consideration and cause a reduction in your approval amount.

- More Funds (2nd-5th positions) MAY be available

- Smaller Funding option continued...Canadian Citizen or Permanent Resident

- No one person business (sole properitors with employees are fine)

Funding is up to $100k on first round and up to $150,000 on renewals for Canadaian Businesses Funding up to $500,000 for American Businesses

Busineses not Eligible:

- One Truck Transportation companies are NOT eligible. Have a fleet of trucks.

- Food trucks not linked to restaurants are NOT allowed

- General contractors with less than $100k in revenue

- Cannabis growers or retail distributors

- Gas stations with no convenience store

- Vending machine operators, ATM Operators

- Property Development - Resource Extraction

- Real Estate Agencies - Property Management

- Computer Repair - Mall Kiosks

- Farming - Charities/Non-Profits

NOTE 1: Once you land on the page after click the button right above, go to the navigation tab that reads "Business Capital" to get started. If on mobile, you can click on the three "hamburger lines" and go from there.

NOTE 2: Equipment Financing specifically doesn't apply to Canada at this time, but you can use the "advance/term loan" option "lump sum" and apply it to equipment if you wish.

Can You Stop Making Payments?

If you stop making payments for whatever reason that is (EVEN if you're sick and were not able to work, well sometimes it's possible WHEN you have a strong enough relationship with a lender but even then it's rare), that's what's called a default and if you've EVER defaulted with another company, there is no forgiveness, and you will very likely not get a second chance.

Although there are a very limited of lenders who may give you a second chance, it's very unlikely to happen and if it does, you'll be given a larger payback amount and limited time to prove yourself.

Now, if you don't make your payments once you have the advance, that'll cause a default, so you have to make sure you will be able to pay it back. Another thing...

If You for whatever reason decide to close your bank account OR calling your bank to disallow payment, it is purposeful non-payment, and it looks like fraudulent activity. So don't be this person (It's very slim that this happens but I've had clients do this).

Personal Guarantees?

Yes, these advances have a personal guarantee, but which option doesn't these days? If you didn't know what a personal guarantee is, it's basically where if you couldn't make your payment(s) for whatever reason that may be and you went into a default, the lender has the right to seize any of your personal assets to recover the cost (car, home, and more). Listen, this is very common...

The reason a personal guarantee is in place is so you are serious and the lender(s) need a way to make their money back somehow, right? Like anything there are consequences. Just about every loan/cash advance comes with a PG, unless you offered up some collateral upfront with like a secured loan.

At least your advantage is not giving up collateral, some type of equity, and real estate in the process.

Credit Bureau Reporting?

No, these advances do not report to the main credit bureau's like Dun and Bradstreet, Equifax, TransUnion, etc), so you don't have to worry if you have bad credit. And even with Goodland above credit, this is very helpful because you may have something on your file you don't want showing or you're not concerned too much with building your credit this way.

How To Get Started

If you’re ready to get funded and receive your decision in minutes, here’s the simple 3 step process:

- Pre-Qualification. You will complete the online form by clicking the button below. Your application will be reviewed and then contacted to discuss available options and answer your questions.

- Complete Application. When you complete the simple application, it’ll provide the lenders and advance companies with more business, personal and financial details. You’ll submit with a few requested documents.

- Submit Documents. To verify your application and secure approval, the program will request 4 months of bank statements, a copy of your last year's business tax return, a canceled check, and a copy of your driver's license.

NOTE 1: Again, When you click the "green" button above, you'll want to go to the "Business Capital" Navigation tab and get your app started there which I'm in partnership with them. If you're on mobile, you can go to the "hamburger lines" at the top right of your screen and begin.

NOTE 2: ONLY (and I'm serious here) Start your application AND Submit it YOU are FULLY Serious and want the VERY Best for your current situation where you're not having to worry about faulty lenders and other organizations/broker/agents fooling with you and wasting your energy and time.

You will get the BEST out of me and the right lender and that goes for communication too..I will be following up with you just to let you know where you are in the proces (NOT to heckle you!), and listen carefully to this next part...

IF I ask for feedback at a point in the process and you go mute especially at the point of an offer (if there is one), I don't want to work with you, it's as simple as that...We're not here to create and increase friction, just make it as smoothe as possible and it'll be quick transitions and before you know it the funds kick in.

To add on, that you're not wasting anybody's energy and time, including the lenders and underwriters, put yourself in our shoes too. But again, if you want the best, you wil get the BEST, just be serious okay?

Monthly Vs Daily/Weekly/Bi-weekly Loans and Advances REALITY

I made a quick video going over the misconceptions of getting a monthly payback with longer term loan vs the Daily/weekly/bi-weekly payments YOU really should watch so you really understand why a monthly payment may not work for you, and why a daily type of payment structure is best as well as how to view things:

Quick points:

- Everyone getting a "Lump sum" either gets weekly or daily repayments even if it's a business term loan and not an MCA which there is also an intermix between a business term loan and MCA that goes for terms of 1-2 years, sometimes 1-3 years.

- The other way to go monthly is to not even have the minimum of 650 Credit and not even 660 FICO but more like 750+ FICO with 3+ years in business, $50k+ per month in deposits/revenue, and stable and strong bank statements with little flucutation, strong daily bank balances, and average monthly bank balances, and then some.

- To get a monthly repayment that's more predictable to get (and initially), it's a business line of credit, an equipment loan through an equipment lender, SBA 7a/504 Lender, or personal/startup loan.

- Just because you "qualify" for some "monthly" 2+ year term business loan with lower interest DOES NOT mean it is best for you! The total cost of financing can be a lot higher, you end up staying in debt for longer even if your payments are lower on a monthly basis and may end up having to put a down payment and or collateral

- Monthly payments cause WAY too many defaults

- You may already be paying high credit card monthly lump sum costs and rent on top of more where you get A LOT taken out at once

- To get a better repayment, in a lot of cases you'll want to BUILD a relationship with the lender(s) for them to give you that access.

- To even get a MONTHLY Repayment "unsecured term loan (meanining a "Lump sum")" lender you should have the following:

- $250,000 if not $300,000 annual gross revenue (but more like $50k+ per month in this market)...

- 2+ years time in business (more like 3+ years in this market)...

- 660+ FICO (but it's more like 750+ in this market)...

- No Bankruptcies/foreclosures/liens in the last 3 years...

- And if you're in trucking, it's at least $75k-$100k PER Month (or about $900k in annual gross revenue) WITH at least 5+ years time in business - Trucking is super HIGH risk that's why.

- Strong daily bank balances, strong average daily bank balances, strong average monthly bank balances, strong cash-flow, not flucutatng and so forth.

- PLUS: You'll have to likely supply more bank statements, ytd financials, recent tax return and so forth and that may be something you're wanting to avoid.

- IF Trucking = 5+ years in business

- Trucking is better to be doing $75k-$100k+ Per month to get a monthly repayment

- Trucking weekly repayment is best to be doing $50k+ per month

- Trucking should also have at least 5+ years AND 5+ Trucks

- Non-Us Based Trucking/Transportation = $800k+ in annual gross revenue

If you meet those requirements right up above for "Monthly" repayment unsecured Term Loan Lender and YOU DO NOT have like more than 2+ Cash Advances open with less than 50% of the balance paid and or 1 advance without at least 50% if not 80%+ of the balance paid...

Then you can see the alternative up to $2M option in the alternative section earlier up above with "business capital with national" and or "gokapital", with national being first over GoKapital and or you can just go through my funding questionnaire form to see your options.

Otherwise continue forward with the up to $2MM option below which is great and will be very helpful, and like I tell ALL business owners, you have to start somewhere to get to that next place and I'll show you in time how to move up levels.

Documents Needed For Up To $2M

- Application - Completed, dated, signed and legible.

- Bank Statements - Most of the time we need the last 3 months. On occasion 12 months IF we're trying to get you half a million or a million+ dollars.

- Voided Check - Requires a voided check on all business account submitted. Many times an account that is submitted has multiple transfers so it's important to see everything that's moving around.

- Drivers License - We will need a copy of your driver's license for all owners on the application.

- Tax Return (optional) - This will ONLY be required IF you're asking for over $150,000. This is asked for so we can see who really owns your business. You can say you have 100% ownership but your K1 only says you own 25%.

- Financials - Only required on all requests exceeding $100k. **P&L Balance Sheet, Tax Returns, AR Report.

Application Process

For a visual/image look of the up to $2,000,000 application process, click here

Extra Notes on your application...

NOTE 1: Again, When you click the "green" button above, you'll want to go to the "Business Capital" Navigation tab of your screen and get your app started there which I'm in partnership with (if you're not already taken there that is). If you're on a mobile device, you can go to the "hamburger lines" at the top right of your screen and begin the process.

NOTE 2: ONLY (and I'm REALLY serious here) Start your application AND Submit it YOU are FULLY (and I mean fully) Serious and want the VERY Best for your current situation and not having to worry about geting the wrong funding from the wrong source.

You will get the BEST out of me and the right lender and that goes for the communication as well..I will be following up with you just to let you know where you are in the proces (NOT to heckle you!), and listen carefully to this next part please...

IF I ask for feedback at a point in the process and you go mute especially at the point of an offer (if there is one there), I don't want to work with you, it's as simple as that...We're not here to create and increase friction, just make it as smoothe as possible and it'll be quick transitions and before you know it the funds kick in.

To add on, that you're not wasting anybody's energy and time, including the lenders and underwriters, put yourself in our shoes too okay?. But again, if you want the best, you wil get the BEST, just be serious about it.

Business Line Of Credit Program

If you didn't know, a business line of credit is where you can get approved for an amount of funding but instead of getting a lump sum of cash all at once with like an MCA or a business term loan, you can withdraw and use the funds whenever you need it.

So let's say you get approved for $30k in a line of credit, then you can take out however much you need from that and use it and only pay interest on what you use. Then once you pay it off, it goes back into your account as a "revolving line of credit"...

And you can keep using it over and over again. This is a great addition if you needed additional funds and have seasonal things come up or for cash flow, emergency funds or similar uses to getting a lump sum - you choose how you best see fit to use it.

Here are some quick details:

- You can get receive a decision in 1-2 business days, requiring ONLY a soft credit pull.

- Simple to understand draw fees and balance fees - with zero penalties and big savings for early payoff.

- No collateral is required.

Requirements:

- 550+ FICO credit score

- $15,000+ per month in revenue

- 1+ years in business

- Anywhere in the United States (US Only)

NOTE: If you've been in business less than 2 years, or your business resides in NJ, CA, RI, NV, VT, or MT, then your FICO score must be 600+. Qualification is also based on other criteria, but not limited to; financial strength of your business, average daily balance, number of NSFs, etc.

If you don't qualify for the Business Line of Credit at this time, you can apply for the working capital advances here:

Also, if you have a business outside of the US (Canada and Puerto Rico), then refer to the alternative section below to learn about the company "GoKapital"

Additional Details:

- Approval amount is 150%-200% your average monthly sales.

- You MUST have at least 5 deposits per month in each of the last 3 months.

- Revolving line. Ex: You use $10,000 of the $30k you're approved for and you pay it off, it goes back into your account and replenishes back to $30k.

- You pay a draw fee and balance fee. As you take money you pay a fee, and as you have a balance that you haven't paid off, every week you pay an interest charge on that balance, so the longer you hold it, the more it will cost you.

- 0-3% draw fees, usually it's 3% but some other lenders we work with have 0 draw fees but you pay a monthly fee of $20 per month. So it can vary.

- Balance fee example: Let's say you have a $50k business line of credit and you take out $10k, each week you'll get charged a percentage, let's say it 3/4 of 1% per week, so you take the $10k x 3/4 of 1% = $75 you pay this week to have that money out. If you pay it all of next week it only cost you $75. But if you hold it longer, than you'll be getting charged next week another whatever your balance is times 3/4 of 1%. So maybe next week it's $75 again.

- You get a weekly payment to pay it off within 6, 9, or 12 months, usually 12 months. So if you take $10k from your total $50k, what would the payment be to pay it all back in 12 months? That's what we calculate. Let's say it's a $300 per week payment (but it can be any), if you pay it every week, in one year that $10k will be paid if with interest. AND if you pay it off early, there is no penalty and you save big. So your minimum payment must be paid every week, it's a weekly auto payment but you're not only restricted to only pay that. You can pay it down and save a bunch of interest. You're only paying a balance fee while you have a balance.

- .-69%-1.39 interest (cost of funds). For example, let's you get approved for $20,000 and withdraw at the minimum $1,000 with a 3% draw fee which is $1,030 then divided by 6,9,or 12 months (depends on what you get) so we divide the $1,030 into the weeks within the months, so let's say you get 12 months which is 52 weeks, then that’s $19 + cost of capital (interest), If.69 then you pay $88 per week.

- I got these numbers from taking the principle of $1,000 with your draw of 3% which you owe $1,030 on your balance, then divided that by 52 weeks (because you got 12 months), and then figured out your interest or cost of capital to be .69 (this number is given to you), so $1,030/52 weeks = $19 + .69 x 100 (which is $19 +$69) and that's $88 per week you'll be paying until you've fully used up your principal of $1,000. I hope that makes sense. It can sound a bit confusing but it's very straightforward. It's an "Amortization" thing which is jargon for your weekly payments and how they are calculated.

An example for $10,000 minimum withdrawal fee at a .75% interest for 12 months (52 weeks) at a 3% draw fee (3% is most common), then:

$10,300 divided by 52 weeks = $198 + Cost of capital (interest), and if the interest is at .75, then, it’s .75 x 100 + $198 = $273 per week you’ll be paying until you’ve fully used up your principal of $10,000.

- I got these numbers from taking the principle of $1,000 with your draw of 3% which you owe $1,030 on your balance, then divided that by 52 weeks (because you got 12 months), and then figured out your interest or cost of capital to be .69 (this number is given to you), so $1,030/52 weeks = $19 + .69 x 100 (which is $19 +$69) and that's $88 per week you'll be paying until you've fully used up your principal of $1,000. I hope that makes sense. It can sound a bit confusing but it's very straightforward. It's an "Amortization" thing which is jargon for your weekly payments and how they are calculated.

- You can lower your weekly payments by drawing out more

- Longer terms can keep your payment down.

- Pre-pay to save big time

- Auto Weekly Payments

- Construction and Transportation Industries must have 2+ years in business

Line of Credit Application Process...

The Line of credit application process is similar to that of the "Up To $2,000,000 Funding" application process I showed you up above (refer to that if need be). PLUS: You can apply for both programs and try to get approved for a "lump sum" ad a line of credit or we can just evaluate you for one if that's what you prefer (but I recommend both).

P.S. Are you doing about $300,000 Per Month consistently ove the last 3 months and on average that and more with stronger credit like 700+ and low DTI and want more than $100k in a line of credit? There's an alternative line of credit program up to $250k without collateral you can see here.

NOTE : Without being redundant again, PLEASE ONLY apply IF you're Serious and are not there to waste our energy and time. If you're serious, you'll get the best out of me and my team

BONUS: Credit Line Hybrid Program with 0% Interest For 6-18 Months Business Credit Card Stacking program you can check out by itself and or add on top of the True Business Line Of Credit

Do you Even Qualify For an SBA Loan (Monthly Repayment Is The Way)?

Listen, EVERYONE wants an SBA EIDL loan, the targeted advance grant, The SBA 7a/504, PPP and so forth but Do YOU actually qualify is the question?

As of now, EIDL is not accepting ANY new applicants, you'd have to already of received funding and are looking for a reconsideration and so forth to continue getting more BUT...

It's not the end of the world. There are other alternatives like the SBA 7a and SBA 504 below but you must know this...

To get these types of loans you MUST have:

- Business credit established with at least a 155 in Business Liquid credit/FICO SBSS and have a decent paydex score.

- Strong cash-flow

- Equity if you have it

- Liquidity can be looked at

- Sufficient Collateral (if needed - Not necessary to supply)

- 10% Down payment (if needed - Needed for business purchases)

- 680+ FICO (660 or sometimes 650+ entry point too)

- 500,0000+ Annual gross revenue ($400,000 or $120,000 or $150,000 - the last two are more for express loans up to $150k and up to $350k)

- 2+ years in business

- At least 2 years of profitability (Most recent is best)

- Great credit and credit reports

- No bankrupticies/forclosures/liens in the last 3 years

- And more!

Even if you had everything needed, it does NOT necessarily mean and SBA Loan is best.

Want to try for yourself and See if you TRULY Qualify for an SBA 7(a) or 504 loan? PLUS See how to get an SBA 7a Loan and get "Bridge Funding" In The Meantime Up To $5,000,000+ Click here to take the SBA Quiz to find out for yourself

Up To $2,000,000 Alternative...

Aside from the "Up To $2,000,000 Lump Sum" program I just shared with you there are alternatives for monthly repayment types of programs like:

- Unsecured (Non-Collateralized) Term Loans from 1-5 years (but not right now in the market, they are not avaialble)...

- Business Lines Of Credit Up To $250,000 as somewhat shown above in the line of credit segment...

- Equipment Financing Traditionally...

- Personal/Startup Loans...

- Credit Line Hybrid (No docs needed and startup friendly)...

- And More

Let me cover the equipment financing and asset back option too below...

Equipment Financing Option...

Are you interested in Equipment Financing/Leasing/Leasing to own with the best? Here are the funding amount and terms:

- You can get funding up to $200,000. Maximum funding is $200,000 per client - NOT per unit

- Approval amount is a rule of thumb of 1x-2x of your monthly revenue. Ex: You have $50k in monthly revenue, that equals $50,000-$100,000 advanced. Of course, it can higher or lower depending on your business situation

- Repayment amount is 7.5%-11% on average. Can be as high as 20% depending on your businesses situation

- 24-72 Month Terms.

- Automatic Monthly Payments

Minimum Requirements:

- Have Online Banking Setup

- Do at least $10,000+ in Monthly sales

- Have a down payment - 0%-30% depending on your credit

- Owner 590+ FICO credit score - FICO 650+ required for startups

- You CAN NOT have ANY Active MCA Fundings

- Current Loan Consideration - If you have a current capital advance, the amount you still owe will be take into consideration and can effect the approval.

- Invoice Required/Purchase Order for Quote

The time from application to funding is usually 1-5 days from the time ALL of your documents are received.

- No long-haul Trucking

NOTE: Once you click on the button above, you'll go over to the "Equipment Financing" tab at the top in the navigation and if on mobile, click on the three "hamburger" lines and select "equipment financing" to get started. If you go directly to the equipment page, then no need to do the above.

Asset-Backed Funding Option...

Did you know you can put up Commercial Real Estate And get maximum funding up to 80% of the property value?

Here are the funding terms and rates:

- Approval Amount is a Rule of thumb being Maximum funding up to 80% of your property value minus the debt on the property

- Example: You have a property valued at $500,000 x 80% = $400,000 - $200k in debt you have on it, then $200k = your Maximum Loan Amount. Of course, it can be higher or lower depending on your business situation.

- Indicative Terms: 7.5%-8.5% on average.

- Up to 5 year ballon and then after it's over you pay the remaining balance and or you can look at refinancing as well.

- Up to 30 years amortized

- Monthly Payments Available

Minimum Requirements:

- Your asset(s) MUST be Commercial and OR Developable Land.

- The Land Equity must be $1,000,000+ Value.

- Commercial Poperty MUST be $125,000+ Value

- NO Resedential poperties are allowed OR Resedential Rental Properties allowed

- Minimum Equity Amount in Your Property MUST exceed 20%

- Have A Business Checking Account - Must be in the name of YOUR business, NOT a personal account used for business

- Have 2+ years time in business

- $75,000+ in monthly sales

- Owner has a 600+ FICO credit score

- At final underwriting steps, an Appraisal, debt docs, etc. will be asked for)

NOTE: When you click the button above, you'll be brought to the home page, once there, click on the "Asset-Backed Financing" option in the navigation tab. If on mobile, click on the three "hamburger lines" and get started there. If you are directed right to the aset-backed page by licking the link above, then don't worry about clicking on the "Asset-backed Financing" tab as you'll already be there.

What I Liked Most About Bitty Advance

There’s A TON I like about Bitty Advance but one of my favorite aspects is the same day funding, why?

When you’re a small business owner in a tight pinch or you just can’t wait many days or months to get your loan “JUST” approved and then given to you, it’s a relaxing and ensuring feeling to get funding straight away without the hassle of rates, and higher qualification you need.

So for that, I really see this as a Life Changing business AND impactful way it can change you as a person because you’ll feel much happier and for that you’ll think more clearly to run your business to the highest peaks and your overall health will be much better.

What I Liked Least

I wouldn’t say there’s anything I disliked and I’m not saying this to be biased but maybe that it’s not for sole proprietors. But even that It’s not a con.

Final Thoughts

What was your favorite part about Bitty Advance you learned here today?

Whether you’re in a tight pinch, you need to grow, expand or for any other reason AND you want/need fast same day funding, there’s no greater option than Bitty Advance, here’s more to that.

You shouldn’t have to feel buried in your concerns and deprived of air because your business is on a decline, rather you deserve to be taken care financially so you can give your own customers and people that help you run your business a unique experience like no other…

One where they’ll even thank you for where you are. Just imagine this...You get approved for working capital, and within a matter of literally seconds your cash is in your bank account -BOOP. Not a moment later you’re staring at your banking account and this glow shines all across your face with a smile to match it…

You’re ready to use your money to grow, expand, pay off other expenses, make payroll and so forth. You’ve expanded your business to twice the capacity and now you’re earning another $10,000+ PER Month, enough for you to justify your loan amount in the first place. Days pass (not weeks or months) and you’re rolling.

If that’s something you want to have in your life and business, then I highly recommend getting started with your bitty advance application below and getting bitty funding fast as well as getting a look from other providers (where we beat the majority of offers)...

Bitty Advance PLUS It's Partnership Program(s) Bonuses ($13,694 Yours Free!)

As an independent agent of bitty advance and it's partnership with other programs, I'm offering small business owners who get "funding" with the company over $13,000 in Free bonuses to help your business push forward faster off and online.

BONUS #1: Facebook Accelerator Course($597 Value). Don’t worry about how to maximize your engagement on Facebook anymore with my video training course which will show you step-by-step how to get maximum exposure to your products/services for the long-term, and understand what it takes to both use free methods to attract more and new customers as well as how to use paid advertising to BOOST your business forward in less times which means you'll increase your sales right away.

BONUS #2: Viral SEO Secret Hacks($497 Value). I’m going to give you my COMPLETE Search Engine Optimization(SEO) course where you will be able to effortlessly get your website as well YouTube and Pinterest ready in less time. If you've been having trouble getting your website to appear in the Google, Bing, Yahoo, etc. search results, this will help you optimize for greater performance.

BONUS #3: 180 Done-For-You Emails by a professional Copywriter($6,097 Value). These done-for-you emails are no joke, a professional copywriter has made sure to give you the best emails you can get for all types of marketing and businesses...anywhere online! These will last you about 6 months+. Just put them into your email autoresponder, sit back, relax, and watch what happens!

BONUS #4: Special Access To ALL of My Social Media and Extra Guides ($197 Value) - So you can have a greater way to make an impact and income on channels like Facebook, Instagram, Twitter, Pinterest, YouTube and Email Marketing which means you're going to crush it and make more money in the long-run.

BONUS #5: Free Access To My Private Facebook Group with 1-1 Coaching($127 + Value). I have a group for like minded individuals who are growing their business and want to become or are digital entrepreneurs. You’re also going to get full access to 1-1 Zoom calls with me!

BONUS #6: My Full Sales Funnel Domination Course($997 Value) so you can grow and scale your business much faster and so you don't have to worry about how to use sales funnels or even create one from scratch! Yep, that's right, I have FREE templates I give away so you can start generating revenue right away which means you'll free up more of your time.

BONUS #7: You'll get my fast action Storytelling for business scripts so you can "sell" without selling($97 Value) which means what? You won't have to feel like a salesman, rather you can use stories to get your point across and make the sale. This is crucial in brick and mortar businesses as is for digital businesses too.

Is it OK if I over-deliver for you?

Special Bonus #1: FREE Complimentary Vacation Incentive ($1,000+ Value). How would you like to get a Free complimentary Vacation to WHEREVER You'd like to go? Whether you want to stay and visit in the US or go international, I will be giving you your dream vacation and or to any place you would like to go (Selected places available and many of them to choose from). Relax in the sun soaked beach, gaze at the endless neon of the Vegas Strip...sample local cuisine at a picturesque Mexican plaza and so much more! This offer is ONLY Given for clients who get a funding of $25k+.

Special Bonus #2: FREE Restaurant Voucher ($300+ Value). I will also be gifting you a Free Restaurant incentive in the voucher amount of $100 or $200. I will show you where to go find locations via your zip code and send you your voucher via email. This offer is ONLY given to client who get a funding of $20k+